Most traders don’t fail because they don’t work hard. They fail because they trade without a precise, clear plan.

They see a price move, jump in, and hope for the best—sometimes the trade works, but most of the time it doesn’t. And even when it works, they can’t do it again consistently.

That’s the real problem: random entries create random results. Trading isn’t a lottery ticket. It’s a process.

Trading is not about luck. It’s about putting the odds in your favour. If you take trades without a plan, your results will always be inconsistent — one small win here, one loss there, and constant frustration in between.

The difference starts with a plan. A planned trade means you know three things before you enter:

Where you’ll get in,

Where you’ll get out if you’re wrong,

and where you’ll book profits if you’re right.

Think about it this way: would you start a journey without knowing your destination or how much fuel you have? Of course not. Yet most traders do precisely that in the markets.

Without this clarity, every trade is just a guess, no matter how good it looks in the moment.

Let’s be real. If you don’t set a Stop-loss, how will you know when to step out of a Bad trade?

If you don’t set a Target, how will you decide when to take Profits?

And if you don’t have a clear reason for Entry, how will you know whether the trade is worth taking in the first place?

This is why many traders keep repeating the same cycle.

They enter too early, or too late, or in the wrong place altogether. Then they exit too soon, or too late again.

The result? Their capital never grows — instead, it keeps decreasing trade after trade.

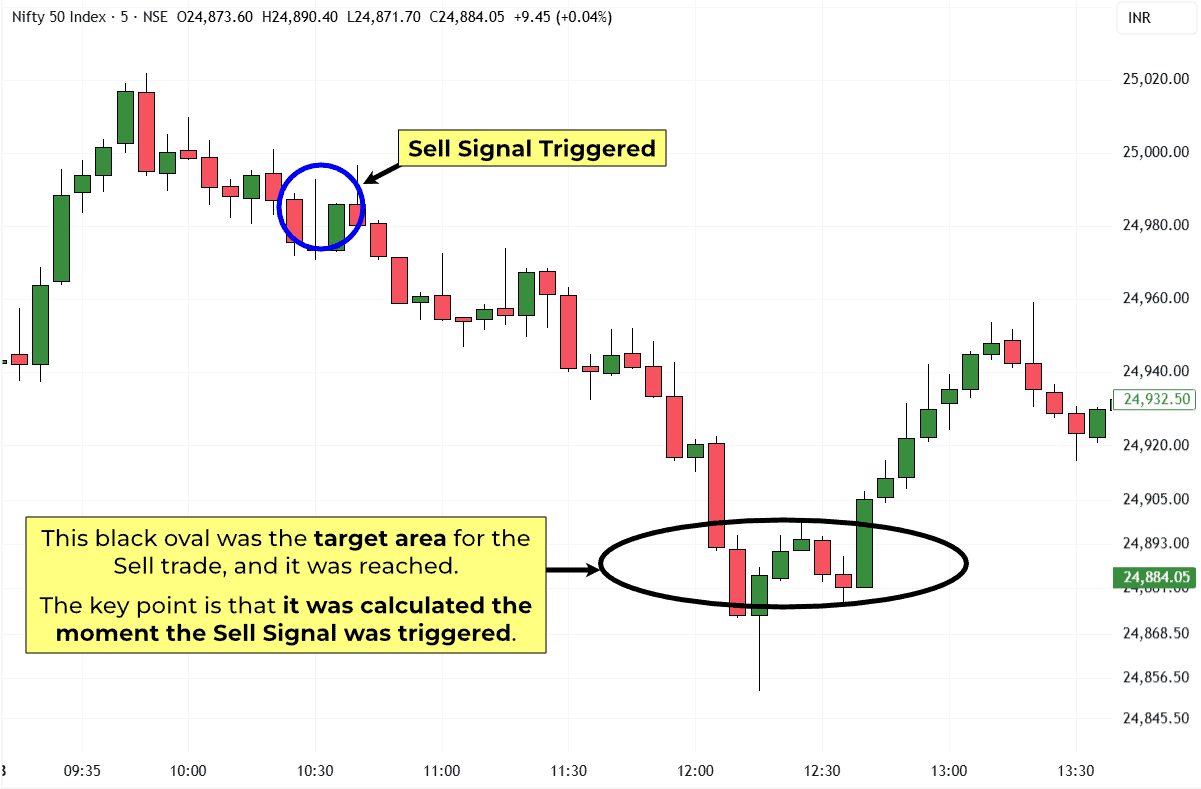

And here’s the proof. Let’s look at today’s intraday Nifty chart.

The black oval shown on the chart was the target area for the Sell trade, and it was reached. The key point is that the calculation for the target was made the moment the Sell Signal was triggered, resulting in a 1:2 risk-to-reward ratio.

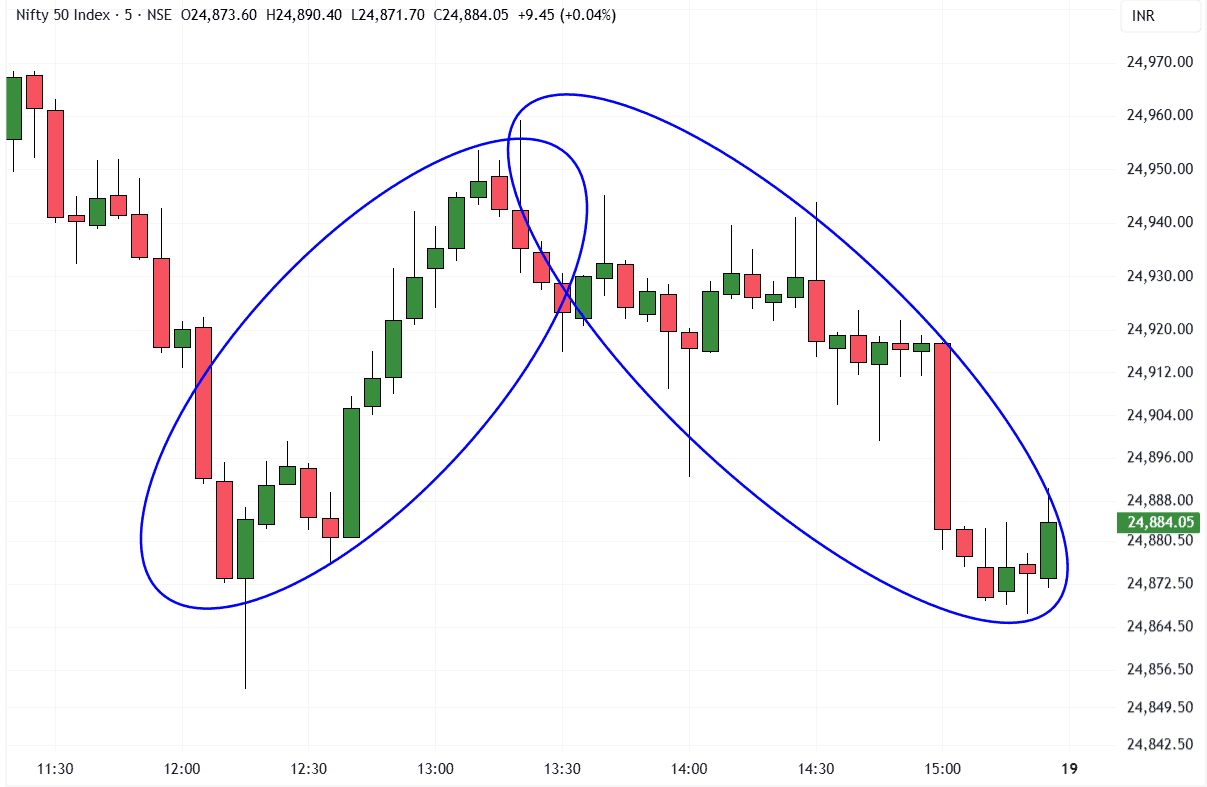

The above chart shows that there were two additional intraday moves in Nifty today, both of which were tradeable with clear entries, stops, and predefined targets. But I’m keeping this post focused on one example to avoid clutter.

The truth is simple: trades backed by a PLAN are more likely to PAY. Random trades don’t.

When every trade has a clear entry, a stop, and a target, your results stop being random. They become consistent.

Trading without a plan is gambling. Trading with a plan is a strategy. The choice is yours. – Divesh

P.S. A full course on this hidden principle is coming soon.