You spend time studying charts.

You wait patiently for the right setup.

You follow your plan and stick to the rules.

And still, the trade fails.

It’s frustrating. Not because you’re doing anything wrong, but because your current trading approach doesn’t show you the full picture.

Even experienced traders face this. The setup looks perfect. Everything feels right. You enter with confidence… and then the market suddenly turns. You’re stopped out. Again.

Why Good Setups Still Let You Down

Most traders start with common chart patterns or setups. These setups seem reliable at first, especially in hindsight, where everything looks clean and obvious.

But in live trades, they often fall apart. What looked like a clear opportunity didn’t work. The market moves in a different direction than you expected.

That’s when doubt creeps in. You start questioning your skills when the real issue runs deeper.

The problem isn’t your execution. It’s that most trading methods offer only a basic understanding of the market.

They focus on what’s popular and widely taught, not on what truly drives price movement.

And without that deeper insight, even a well-planned trade can fail.

Trends That Start… and Leave You Behind

Another common struggle is staying with a trade once it starts working.

Trends can last days, weeks, or even months. But most traders either exit too early or enter too late.

Sometimes you jump in early, then exit during a normal pullback. At other times, you wait too long, and by the time you enter, the move is nearly over.

Later, when you review the chart, you see what you missed. You couldn’t stay with the move, not because you lacked discipline, but because your method didn’t give you the confidence to hold on.

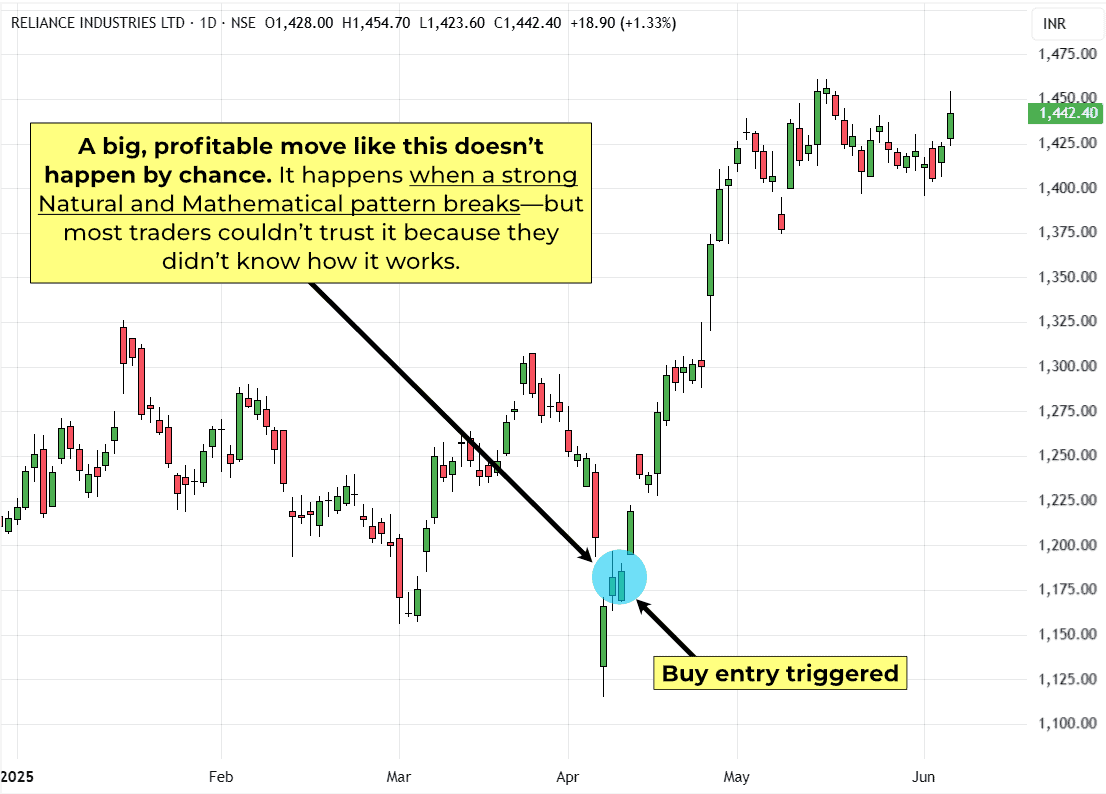

Here’s an example of how that happens in real time.

And Then Come the Traps

False breakouts are some of the most frustrating parts of trading.

You wait. You plan. The breakout forms. Everything looks solid.

Then the market flips, and you’re out of the trade.

It’s not just the loss that hurts. You start doubting the chart, the process, and your own judgment.

The truth is, your method can’t separate the real moves from the fake ones. And over time, these traps don’t just cost money but slowly wear down your confidence.

The Problem Isn’t You, It’s What You’re Watching

Here’s a thought: What if the problem isn’t how you trade? But what have you been taught to focus on?

Most traders are trained to watch indicators. But these are just price reactions. They don’t explain what’s driving the market.

You can’t predict the market, but you can learn to identify specific patterns and setups that quietly repeat over time. Patterns that are based on Natural and mathematical setups.

Let’s look at some real charts to see how these patterns actually work.

The problem is that most tools don’t reveal this. So you keep reacting to what’s already happened without understanding what’s really unfolding.

But here’s the most important part to notice.

After the buy trade was triggered, Crude pulled back for a while. Most traders thought the trend had changed and started going down. But that wasn’t true.

It was just a normal pullback, not the start of a downtrend. Still, many people got out of their trades too early because they didn’t understand what was really happening.

I’ve been exploring these deeper patterns and setups in my own trading for years. And now, I’m building a new course that shows exactly how I use them.

What Most Traders Overlook

If you’ve been through this, missing trades, getting caught in false breakouts, or exiting too soon, you’re not alone. You’ve worked hard. But if your focus is in the wrong place, even your best efforts won’t bring results.

Most traders rely on common strategies. But those don’t show what’s actually happening beneath the price.

When you start to identify the patterns (natural and mathematical patterns setups) that quietly repeat in the background, things begin to make sense. You stop reacting to every move. And start trading with more clarity and less stress.

It’s not about doing more. It’s about seeing differently.- Divesh