Yesterday, we discussed why good entries aren’t enough. The real test lies in how and where you exit the trade.

This week’s Nifty move is the perfect example of that.

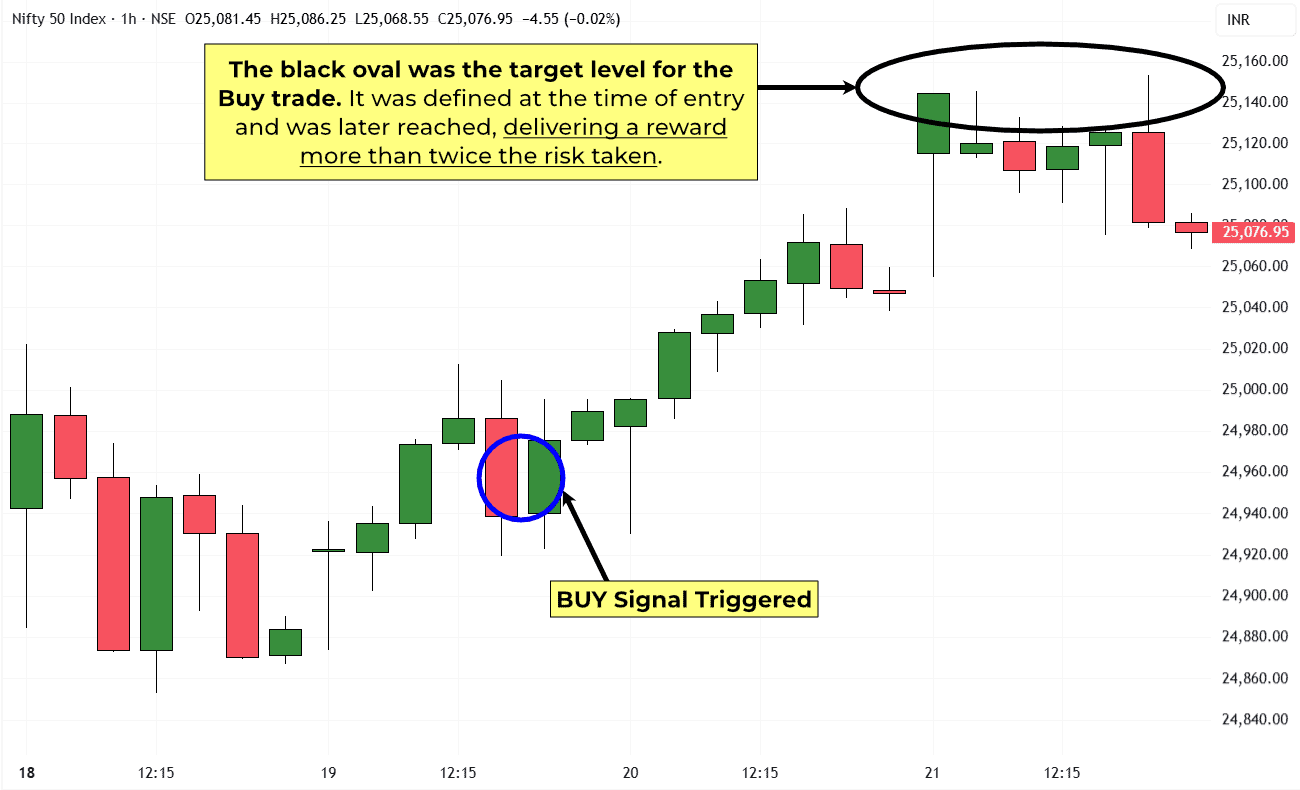

On Tuesday, Nifty triggered a Buy signal on the hourly chart.

By Thursday, it reached the target we had calculated at entry, delivering a clean 1:2 risk-to-reward outcome—twice the reward for the risk taken.

And what happened after the target?

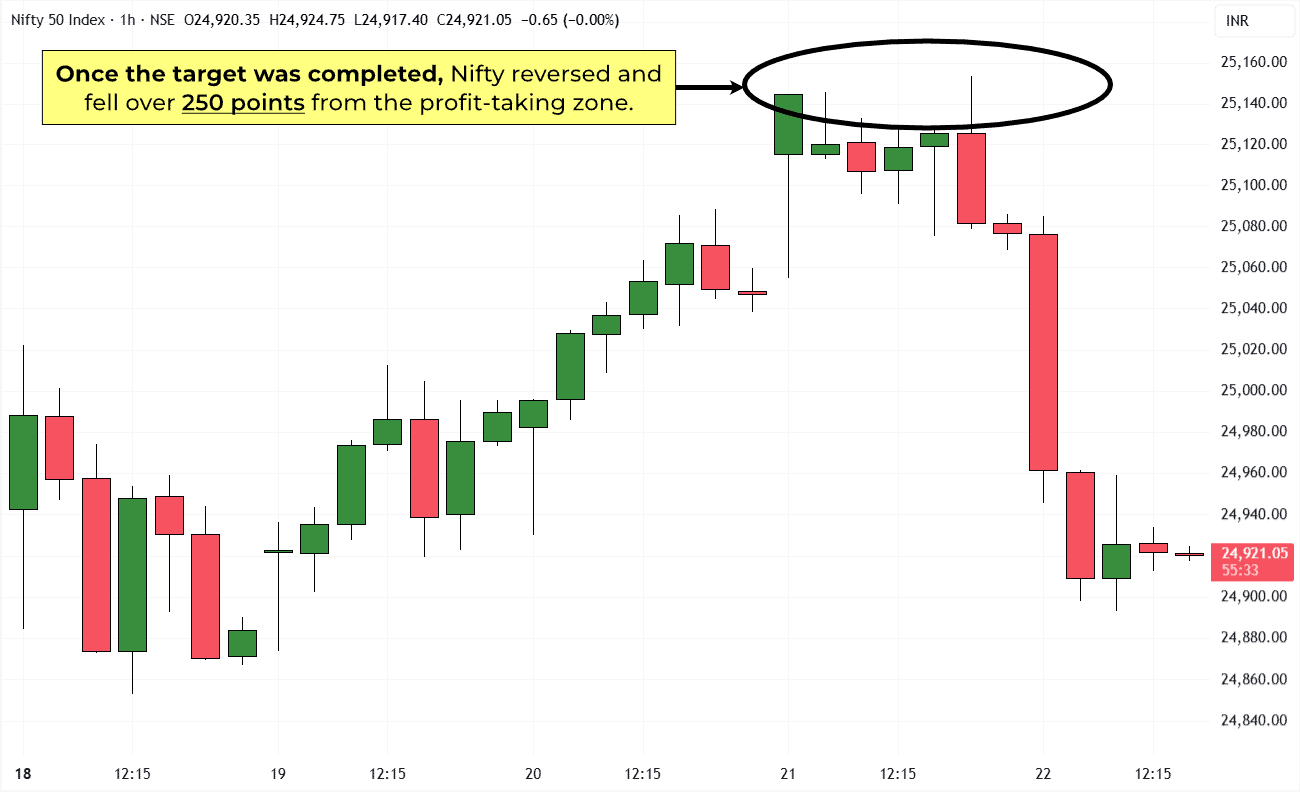

Nifty didn’t continue higher. It reversed and has already dropped more than 250 points from that high.

That single move proves the point:

Traders with a planned exit booked profits and stepped aside.

Traders without one, who kept holding “for more,” have already seen those gains vanish.

This is why exits matter. Entries may open the door, but exits decide what you take home. The Nifty chart proves it: the market doesn’t reward hope, it rewards rules.

What most traders don’t see is that entries and exits are closely connected. Both are part of a deeper market framework based on maths and natural laws. Behind it is a principle that’s rarely shared openly.

That principle is the foundation of my upcoming course—the most powerful work I’ve published so far. – Divesh