Traders often talk about having an edge — something that sets their decisions apart from the crowd.

In our previous discussions, we explored how that edge often comes down to something deeper: unique market knowledge — the ability to see what most traders miss and act with quiet clarity rather than noise.

But in real markets, what does that actually look like?

Often, it’s about learning to see things others don’t. Often, it’s about knowing when not to act, when to slow down, and when to step back — even when everything looks positive on the surface.

That’s where deeper knowledge reveals its true value.

And that’s exactly what happened recently.

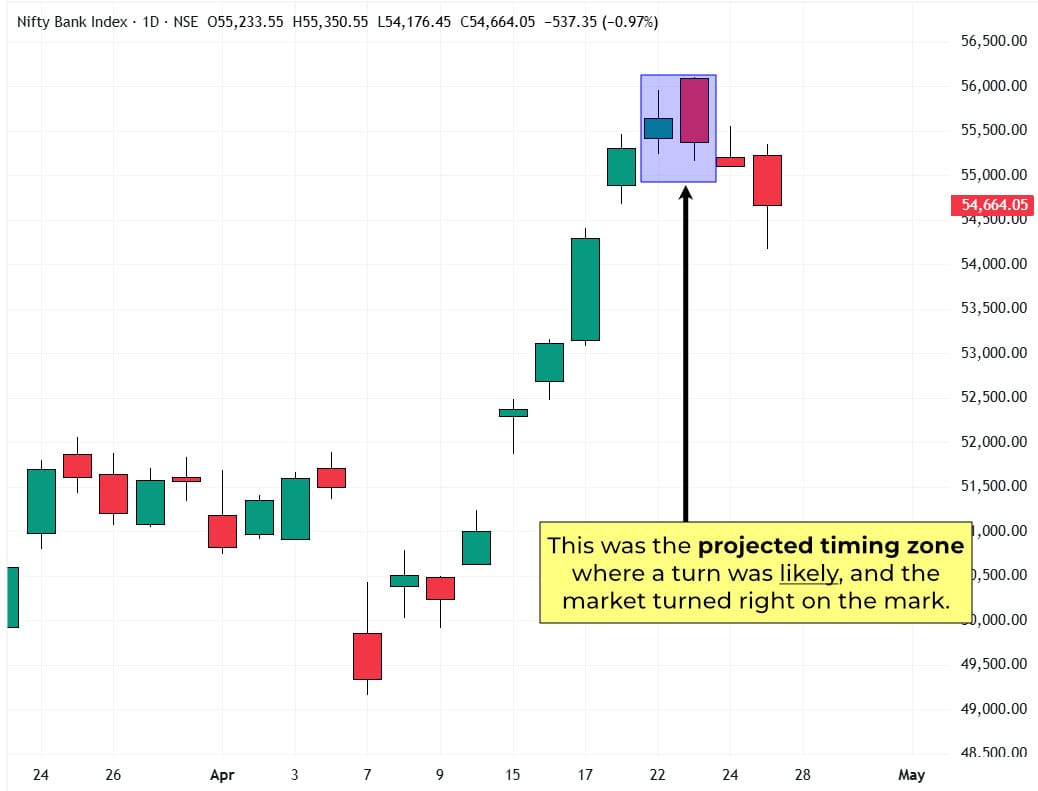

Bank Nifty caught everyone’s attention with its sharp climb and growing strength. Price was rising fast, momentum was clearly on the buy side, and most traders were fully involved in the move.

The price continued to rise, but time-wise, Bank Nifty was approaching a critical timing point where a reversal was likely to occur, even if only temporarily.

That was enough to stay cautious. No indicator said it, but the timing structure was showing signs of a possible reversal. In this case, it pointed toward a high forming — and that’s exactly what happened.

On April 23rd, Bank Nifty made a high — the expected top. And in the following days, it dropped nearly 2000 points — a sharp and unexpected fall for most.

That’s what unique market knowledge looks like in practice. It doesn’t always tell you exactly what will happen next, but it gives you enough transparency to step back when it matters most.

That’s the key.

Unique knowledge doesn’t shout. It quietly prepares you. It helps you make decisions that don’t feel dramatic, but make a dramatic difference.

You won’t find it in the usual indicators. The methods and principles we use come from a deeper study of W.D. Gann’s original work — especially his hidden timing techniques.

These aren’t the common Gann ideas you see floating around online. They’re hard-earned insights we’ve shaped into a clear, practical process through our course, The Hidden Market Timing Principles of WD Gann.

They’re not based on indicators or software, but on timeless principles that apply across markets, timeframes, and conditions. – Divesh

If you’re interested in learning more about the Hidden Market Timing Principles of WD Gann course, feel free to email me at [email protected]. I’ll be happy to share the details with you.