Trading The Universal Sequences

The Hidden Patterns and Natural Forces That Govern Market Movements

(This page has all the details about this course, including pricing.)

Why Your Trades Keep Failing Even When You Follow the Rules

Most traders rely on the traditional chart patterns they’ve learned.

But when it comes to real trades, those patterns often don’t play out the way they expect.

The pattern looks clear, but something still goes wrong.

That’s because the most important part, the real structure behind those patterns, is missing.

And that’s not the only problem.

Most methods don’t give you the clarity to stay with a trend.

A strong move can last for weeks, months, or even years, yet many traders either exit too early or get in too late.

Even in short-term or intraday trades, the same confusion creeps in.

And here’s another gap that rarely gets attention.

The majority of traders lack a dependable approach to evaluate whether a trend reversal will lead to a significant movement or just a small shift in trend that doesn’t go far.

Without that understanding, they either miss out on the real opportunities (the bigger moves) or get caught up in trades that go nowhere.

Then there’s something even more frustrating.

False breakouts.

You wait, you plan, you enter… and the market flips.

You get stopped out again and again.

You stayed patient. You waited. And still, your trade turned against you.

It’s just that your method can’t filter out the fake moves.

And over time, those small losses eat up your profits.

The hard truth?

Most conventional trading methods don’t teach you the factors that impact price movement, what triggers a meaningful trend, how to stay with it, and when a reversal is worth acting on.

That’s why even good trading setups fail, no matter how much effort you put in.

Introducing: Trading the Universal Sequences

The Hidden Patterns and Natural Forces That Govern Market Movements.

What if the problem isn’t how you trade, but what you’ve been taught to look at?

Most traders focus on the surface. They rely on common patterns and rules they’ve picked up over the years. But they never learn the deeper structure that actually causes the movements.

That’s where everything changes.

Trading the Universal Sequences is a two-part course that introduces you to a completely different way of seeing the market, through two unique sequences that most traders either ignore or misinterpret.

In Part 1, you’ll learn a Natural Sequence—a pattern rooted in nature. It’s something many have heard of, but almost no one uses it correctly or effectively.

This course gives you a practical method to apply it, so you can identify those setups and enter and exit your trades with greater confidence.

In Part 2, you’ll discover a Mathematical Sequence that comes directly from W.D. Gann’s most important book, The Tunnel Thru the Air.

This method gives you the structure to trade and stay with bigger moves, those that unfold over weeks, months, or even years. The same approach also works beautifully on shorter intraday timeframes, like a 5- or 15-minute chart.

It’s a Mathematical framework that requires a completely different mindset to understand, which is exactly why most traders never see it, or even know about it.

On top of that, you’ll learn a rare mathematical-based insight that helps you distinguish between major and minor trend reversals. It helps you choose and take only those trades that are more likely to deliver bigger, meaningful moves.

But there’s something else that makes this course truly different.

You’ll also learn a unique confirmation method that filters out fake moves and false breakouts. This has never been shared or taught in any of my previous courses.

Honestly, this hidden approach alone is worth FIVE times what you’ll pay for the entire course. Because once you stop falling for traps, your confidence changes, and so does your trading outcome. In short, this single concept can transform your results.

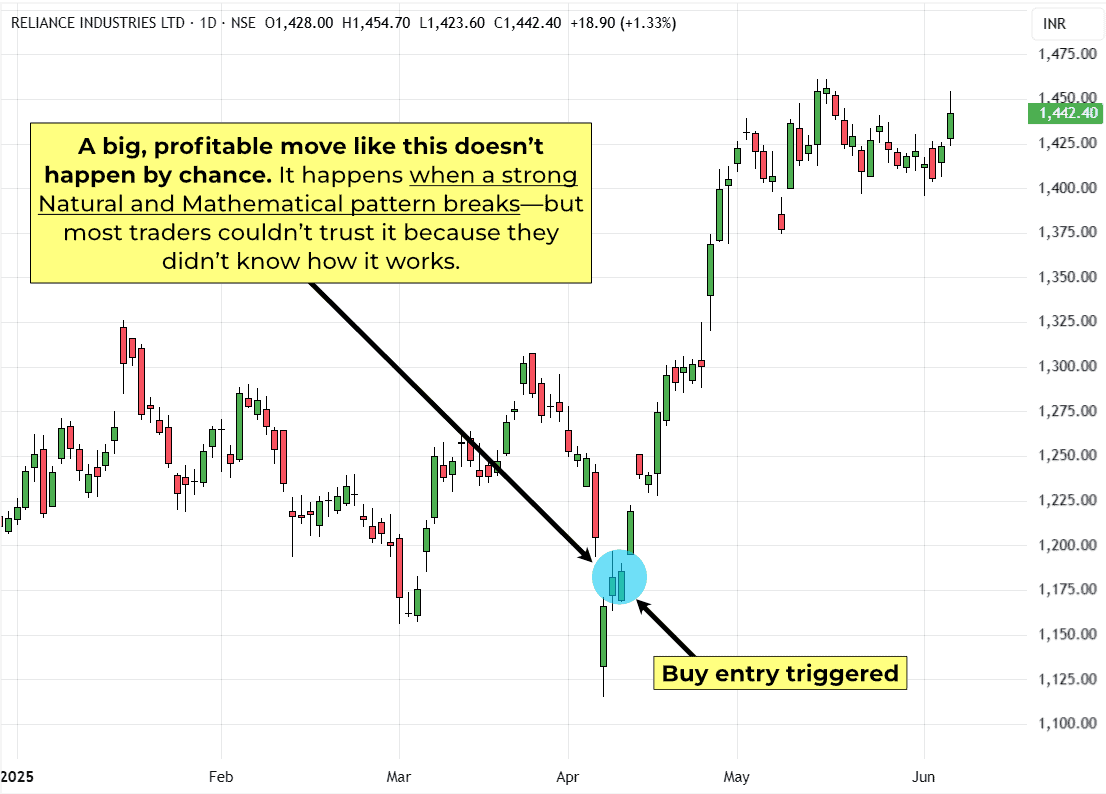

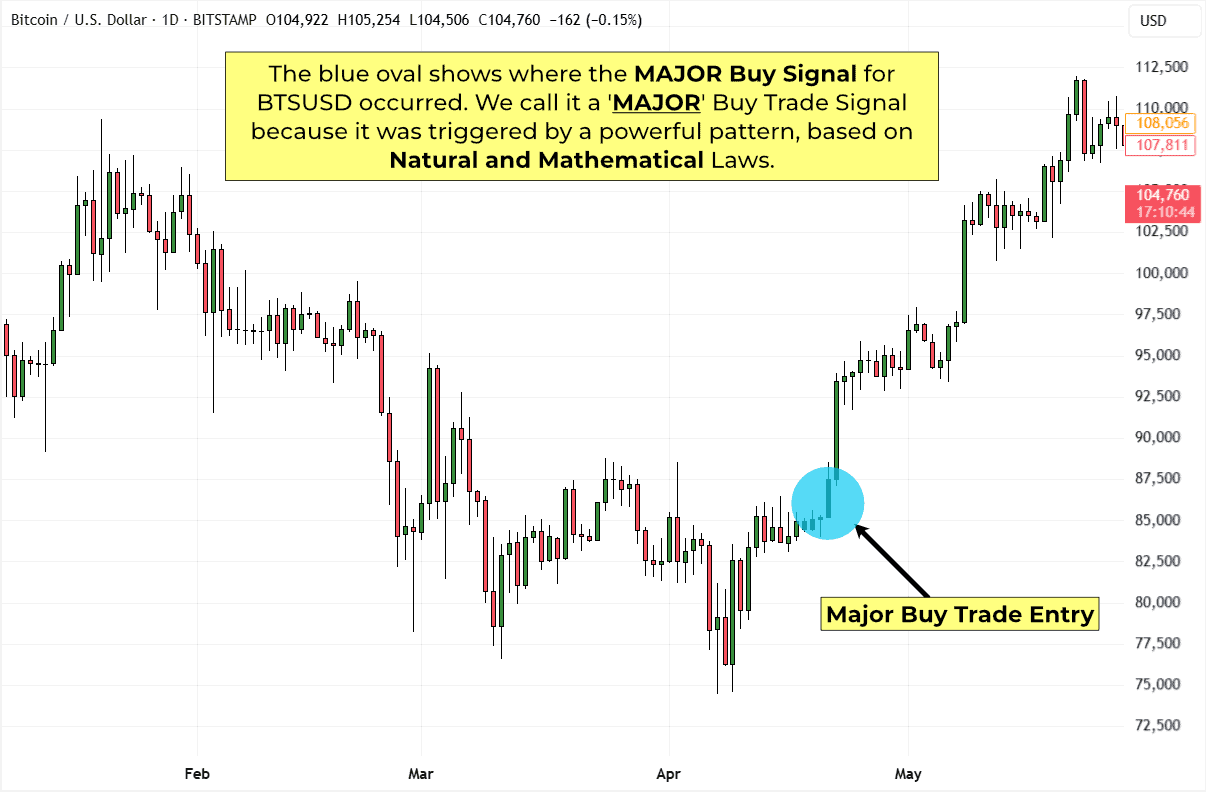

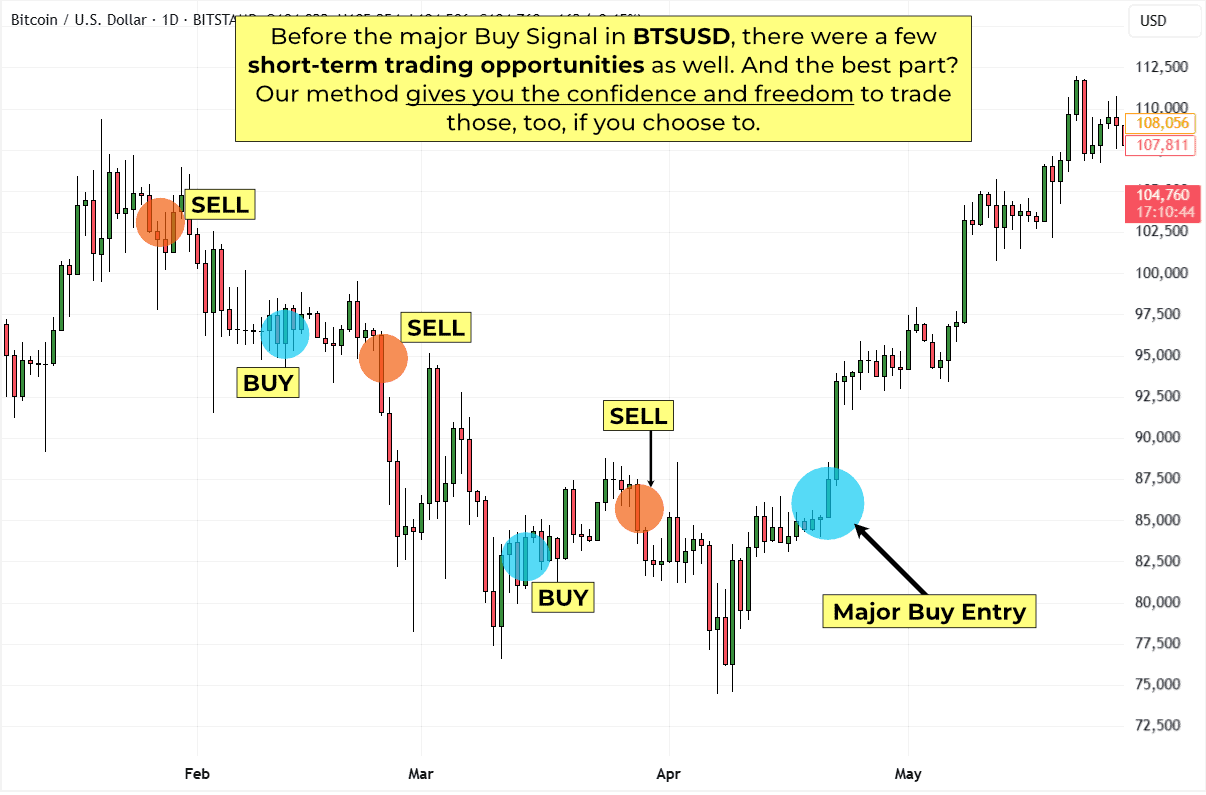

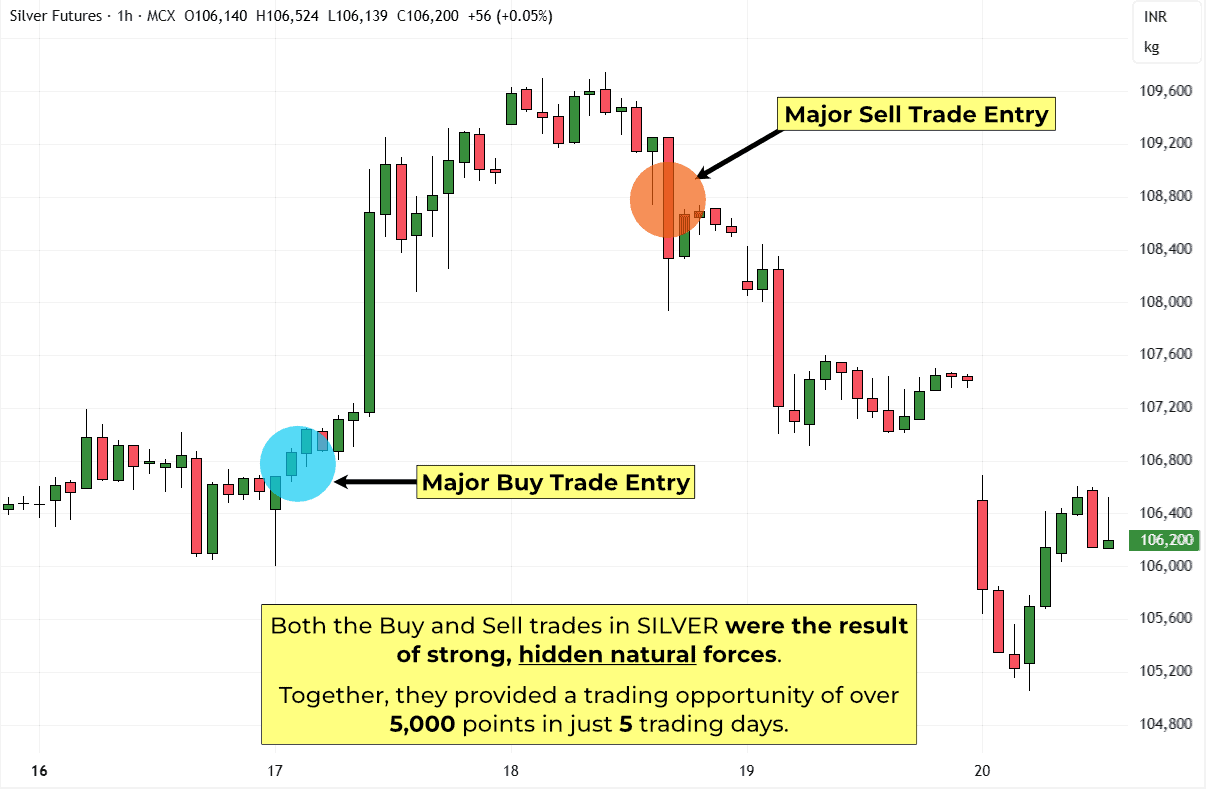

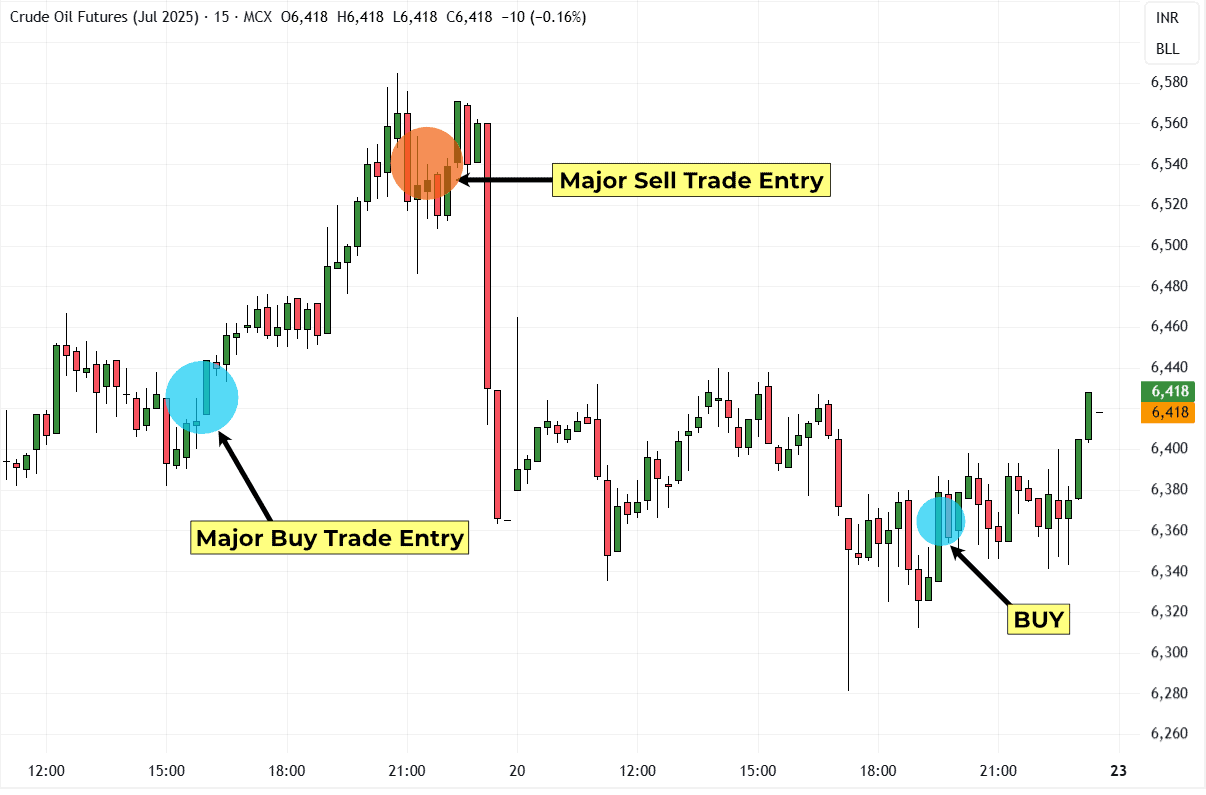

The following are some examples of charts from the ‘Trading the Universal Sequences’ course.

Just look at the chart above to see where those short-term opportunities occurred.

Here’s what You’ll Learn from this Course

A deeper look at the hidden forces behind price movements that most traditional methods completely miss.

A fresh way of looking at the markets that helps you move beyond surface-level analysis.

A Natural Universal Sequence that helps you identify trend setups and gives you a practical approach to plan your entries and exits.

A Mathematical Sequence derived from W.D.Gann’s “Tunnel Thru the Air,” refined for practical trading.

A simple yet powerful mathematical insight that helps you evaluate whether a trend change is minor or major, so you can focus only on high-impact trades.

How to use this approach even on fast-paced intraday charts like the 5- or 15-minute time-frame.

A powerful confirmation tool that reduces the chances of getting caught in fake breakouts and false signals.

Over 100+ chart examples to help you understand the concept.

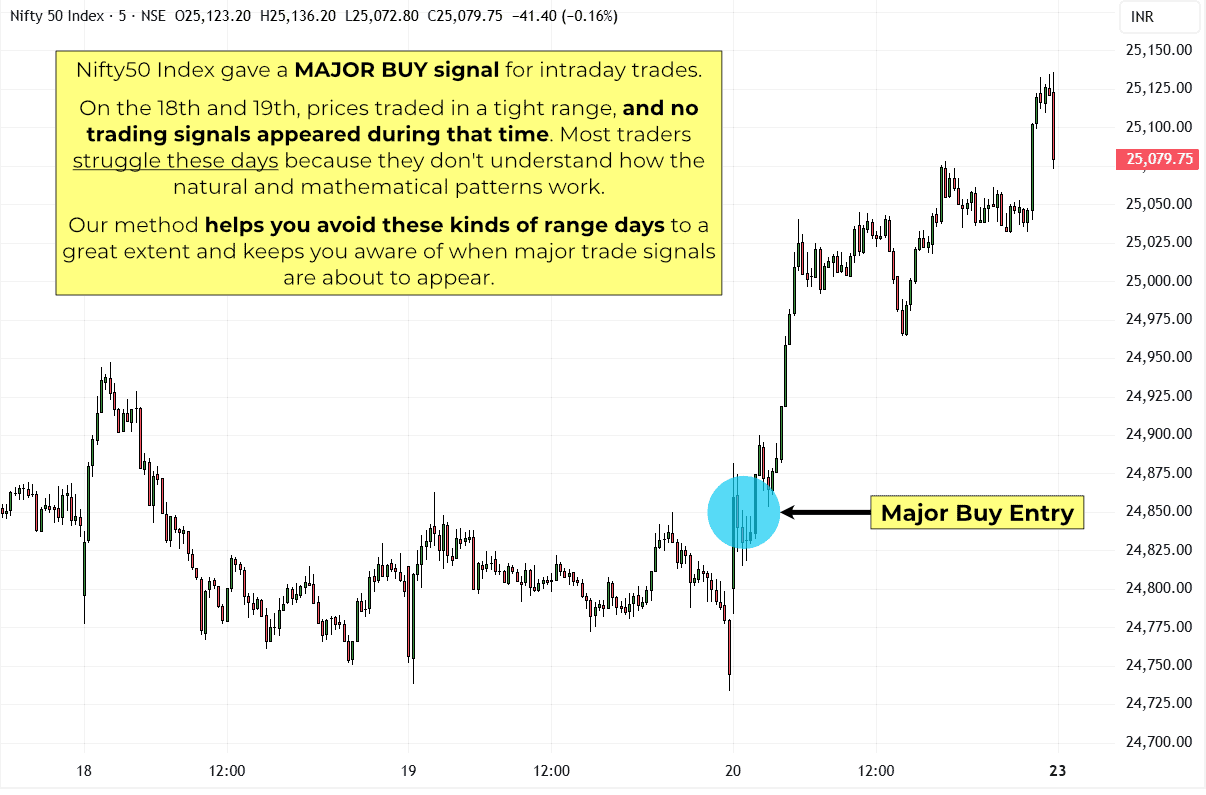

A few more Chart examples from the ‘Trading the Universal Sequences’ course.

Together, they provided a trading opportunity of over 5,000 points in just 5 trading days.

On the 18th and 19th, prices traded in a tight range, and no trading signals appeared during that time. Most traders struggle these days because they don’t understand how the natural and mathematical patterns work.

Our method helps you avoid these kinds of range days to a great extent and keeps you aware of when major trade signals are about to appear.

Here’s What Students Say About Our Past Courses.

This is our newest course release, but here’s what traders have said about our previous courses.

“I had zero trust in trading mentors, but Divesh’s courses proved me wrong”

The biggest reason I hesitated before joining was simple—I didn’t know who to trust. In the world of stock market education, genuine mentors are rare. But right from the start, Divesh Sir stood out. He shares real, practical knowledge, not fluff—and that alone built immediate trust

I enrolled in two courses—Beyond the Noise and The Hidden Market Timing Principles of W.D. Gann—and the experience was way beyond my expectations. Both courses felt fresh, insightful, and most importantly, logical. The concepts were crystal clear and took the guesswork out of my trading completely.

The top three benefits I gained? Confidence, Patience, and No Guesswork. And that first one—confidence—is something not everyone builds so quickly. But with Divesh Sir’s methods, the more I practised, the stronger that confidence became.

I highly recommend these courses to anyone serious about trading as a profession. The value is far greater than the fee, especially if you’re committed to learning the right way.

— Y.R.

India

Beyond The Noise and The Hidden Market Timing Principles of WD Gann Course Student

Frequently Asked Questions

You have questions, and we have answers.

Yes, the concepts explained in this document are easy to learn. It can be used by traders, regardless of their background or experience in trading.

There is no need to have any specific software.

As long as you have access to any Trading software or to any websites from which you can access charts, you can use it.

In fact, you can even print the chart and still use the knowledge on it.

It’s a huge Myth, and it’s totally Wrong.

You don’t need to know anything about Astrology. All you need is a chart, and you should use it as our course material suggests.

These concepts are based on Natural Universal laws and Mathematics. And they will continue to work forever.

It’s like 1+1=2. Will this equation change after 20, 40, or even 100 years? No, because it’s based on mathematics.

It’s the same with all the methods that we teach. They can be learned once and can be used forever.

No, the course content will apply to all charts—stocks, futures, currencies, commodities, and even to modern-day man-made markets, such as cryptocurrencies. It can be used on all time frames, from 5-minute to monthly charts.

We have students from different trading backgrounds. Some of our students are day traders, and others are swing traders. Some trade stocks, some trade futures, and some trade commodities.

But our concepts/methods can be applied to any chart and in any timeframe, regardless of your trading style.

You can read the contents of the course in a couple of days.

After reading, I suggest you practice them on charts for at least 3-6 months to solidify your understanding of the concept. Once you are confident, you can start taking real trades.

The method’s success rate is good, but there is no fixed threshold, such as 80% or 90%.

Trading does not work on one or two trades. It works over a series of trades. Some trades will give small losses. Others will give strong gains.

For example, the first three trades may end in small losses. The fourth or fifth trade may be the big winner. But what if someone skips the fourth and fifth trades because of fear?

Then they blame the method instead of understanding how trading really works. The real game is simple: take every valid trade your method gives.

To see proper results, you must apply the method consistently. Every valid signal should be taken. The focus should be on execution, not on chasing a fixed success rate.

Once you shift your thinking this way, you stop worrying about percentages. You start focusing on making money over a series of trades.

The course fees are high because all these courses/methods are the result of 20+ years of research into Gann studies.

They are uniquely designed and Original and cannot be found anywhere on the Internet for free or for a fee.

Why should you consider investing in the course now?

There are two reasons.

Your goal is to become a professional trader: I know many people who try out “trading” without putting in serious work.

And no wonder they lose their money quickly and quit trading completely. Our courses are not for these people.

The intention behind our courses is to really make you a professional trader, one who is serious about putting in the time, money, and effort.

If you approach trading from this angle – to become a professional trader, then these course prices are relatively reasonable and affordable.

People spend a couple of lakhs on engineering, medicine, etc., because they are well aware of the benefits they’ll reap later.

It’s the same with trading, too. If you invest in the right source, a few years down the line, you’ll reap the rewards and be happy you made the decision yourself.

Course prices might increase in the future: Our courses are unique, and we sell only a limited number each year (only 5 copies of this course are sold). So you might consider investing now, then waiting for the future.

We don’t offer any Money-Back Guarantee.

But we guarantee 100% satisfaction with the trading knowledge you gain through our courses, which you cannot find anywhere else, online or offline.

This alone gives you a unique advantage over other traders and separates you from the crowd.

If you have any questions or doubts about the course content, you can email me through www.transfernow.net (it’s free), and I’ll reply within 24-48 hrs.

If you are still uncomfortable with the concepts, even after a couple of emails, I’ll arrange a one-on-one online session to address your query and help you feel more comfortable with them.

I won’t leave you alone after your purchase – it’s my responsibility to ensure that your questions are resolved and that you are clearer with the concepts/methods.

That’s also one of the reasons we sell limited copies (5 per year): so we can give students’ questions our full attention and help them out.

The support is valid for one year from the date of course delivery.

The support system is strictly via email through (www.transfernow.net), and we don’t have any social media platforms for discussion.

What Makes This Course Different and How It Can Help You in Your Trading

What sets this course apart is its foundation, built on two powerful sequences (patterns) that are missing from almost all traders’ trading strategies.

These techniques are the result of years of focused research drawn directly from W.D. Gann’s Tunnel Thru the Air.

Gann never reveals them openly, but the clues are there, hidden in the story, waiting to be decoded. That’s precisely what we’ve done. We’ve taken those insights and turned them into a practical trading approach.

Most courses teach what is already widely known.

The same traditional patterns and indicators that every other trader is using. They may look attractive, but they rarely teach you anything original, practical or anything that works in real market conditions.

But this course teaches you exclusive and highly reliable trading techniques that most traders are unaware of. It gives you highly practical and repeatable strategies so you can use them in your trades and reap the rewards.

You’ll learn about the deeper hidden patterns and Natural Forces that impact price movements, as well as the Mathematical Sequence that influences trend formation and reversals.

It gives you a solid strategy to understand why a move is unfolding, whether it’s worth trading, and how to stay with it once you’re in a trade. But it doesn’t end there.

These strategies will also help you practically evaluate when a trend shift is meaningful and worth acting on, not just another minor fluctuation, and how to avoid being fooled by false setups that look promising but fail to deliver.

Everything within this detailed course is explained in easy-to-understand words and with over 100s of chart examples, so you’re not left confused about how to use it. You’ll be able to apply both sequences practically and build solid confidence in your trading decisions.

How do I Buy this Course?

When you purchase any of our courses, you’re required to sign a Non-Disclosure Agreement with us not to share the course’s contents with anyone in any way or by any means.

Please do not consider investing in our courses if you are not willing to sign a Non-Disclosure Agreement (NDA) with us.

We sell only 5 (five) copies per year of this course. Our intention is not to cater to the Masses.

The GOAL is to offer it to a small number of traders who are interested in the Original trading work of WD Gann and want to understand the Truth(s) of the markets more deeply.

What are the Steps involved in Purchasing this Course?

Below is the step-by-step process you need to follow to purchase this course.

Step 1: You need to send an email to [email protected] expressing an interest in purchasing this course.

Step 2: After that, you will receive a KYC form and Non-Disclosure Agreement (NDA) from our end, which you must fill in and email back to us.

Step 3: As soon as we receive your KYC form and Non-Disclosure Agreement (NDA), we will send you the bank account details for transferring the course fees.

Step 4: Once we receive your course fees, we’ll email instructions to download the course files to the email address you gave us in the Non-Disclosure Agreement (NDA).

The whole process is smooth, and I will be there to help you along the way. If you get stuck or need help at any point in the process, then please email me right away at [email protected] – I’ll help you as soon as possible.

Secure Your Copy of ‘Trading the Universal Sequences’ Course

Special Introductory Price: ₹1,75,100 INR (Approx. $1,940 USD)

(The Course Booklet – A Protected Digital PDF)

Includes Lifetime Access and One Year of Personal Support.

This, along with our other courses, is offered exclusively to a limited number of traders each year. Only 5 (five) copies are available annually.

So this is your rare opportunity to learn a Natural Sequence based on Universal and Mathematical Laws derived from W.D. Gann’s Tunnel Thru the Air, both of which reveal and teach you the practical techniques of trend reversals and trend formation.

You’ll also learn a powerful confirmation method to filter out false breakouts and practical mathematical insight to help you distinguish between major and minor trend changes so you can focus only on meaningful moves.

Important: The current price is only valid for a limited time and may increase soon due to the course’s exclusivity.

If you’ve been searching for a reliable and structured way to make better trading decisions without guessing or relying on surface-level strategies, then this is your chance to Join a highly selective group of Elite traders learning these powerful trading strategies and principles.

Secure online payment for Indian buyers is processed through Razorpay (Credit & Debit Cards / UPI / Net Banking).

For international buyers, secure online payment options are available through Wise, PayPal, Xoom (Credit/Debit Cards, or direct Bank Wire).

Here’s What You’ll Learn from This Course

A deeper look at the hidden forces behind price movements that most traditional methods completely miss.

A fresh way of looking at the markets that helps you move beyond surface-level analysis.

A Natural Universal Sequence that helps you identify trend setups and gives you a practical approach to plan your entries and exits.

A Mathematical Sequence derived from W.D.Gann’s “Tunnel Thru the Air,” refined for practical trading.

A simple yet powerful mathematical insight helps you evaluate whether a trend change is minor or major, allowing you to focus on high-impact trades.

How to use this approach even on fast-paced intraday charts like the 5- or 15-minute timeframe.

A powerful confirmation tool that reduces the chances of getting caught in fake breakouts and false signals.

Over 100+ chart examples to help you understand the concept.

Important details

If you have any payment issues, then please email [email protected] – I’ll help you as soon as possible.

As soon as your payment is complete, you’ll receive an email with instructions regarding accessing the course in secure PDF format.