WD Gann’s approach to the markets was entirely different from anything most traders use and learn today.

Gann didn’t see the market as random. To him, it was a puzzle. One that could be solved if you knew how the pieces fit together.

Those pieces were Price, Time, and Pattern. He believed these three elements, when understood correctly, revealed the fundamental structure behind market moves. When you know how these three complement each other, you begin to see trades that most traders fail to see.

Unlike modern strategies that rely heavily on indicators, Gann’s method was based on natural laws and logical principles that are far deeper and more reliable.

In this article, we’ll take a closer look at the three building blocks that contribute to Gann’s approach to trading. They’re often overlooked, but they hold the key to spotting powerful trend shifts and timing trades with more precision.

Let’s explore how each one works—and why they matter.

The Absolute Importance of Price

When you look at an asset’s ‘Price’, it’s more than just a Number. It represents the collective emotions of traders, including Greed, Fear, and Expectations, all compressed into Numbers.

In traditional technical analysis, ‘Price’ is considered as a Static indicator. However, in the Gann methodology, it’s a dynamic entity that interacts with other market Factors such as Time, Pattern, and Volume.

Think of ‘Price’ as a well-crafted story in literature. A good story provides information about the characters, setting, and conflicts. Similarly, ‘Price’ tells the story of the market, including its Trends, Volatility, and Potential future effects.

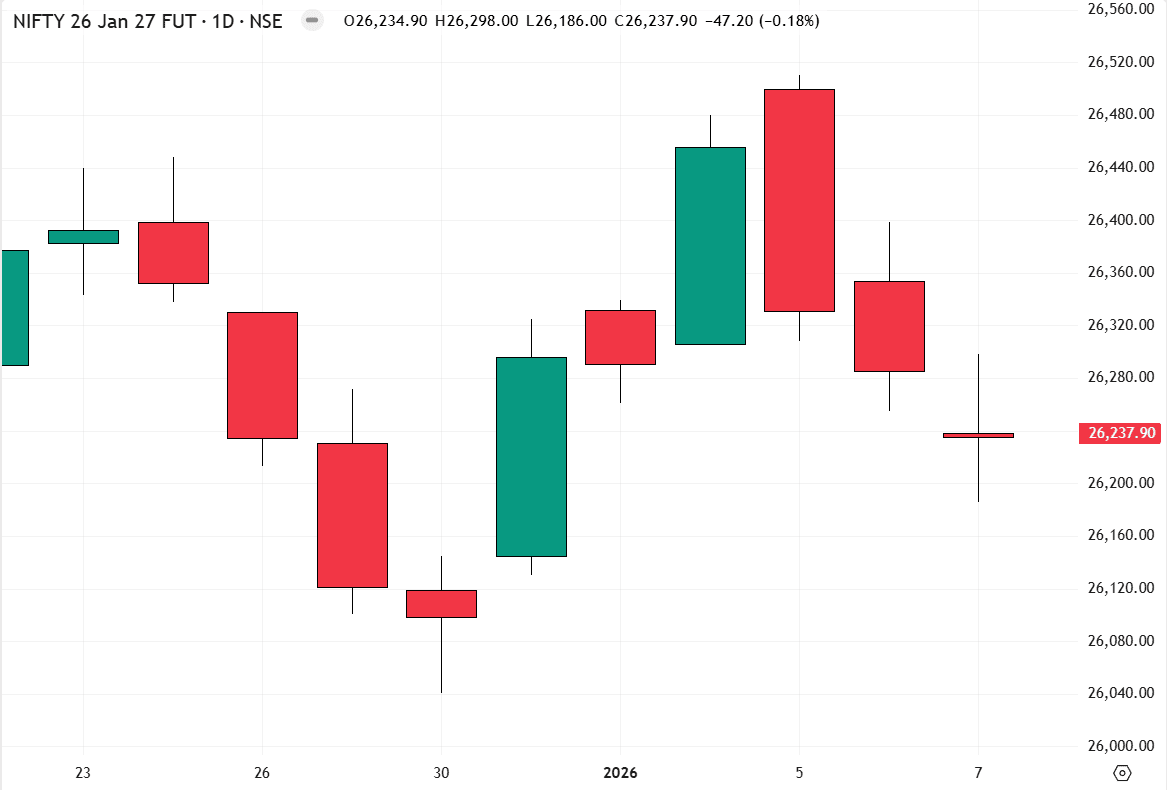

Time: The Often-Ignored Component of Market Analysis

Traders often focus solely on Price, neglecting Time as a dimension. However, this is a critical mistake since Time significantly impacts the duration of trends, their reversals, and the extent of those reversals.

Understanding that Time in the market is not linear like a clock is essential. Instead, it has a fractal nature of varying lengths, each with its predictive power.

Knowing the right moment to enter or exit a trade can determine whether it will be profitable or not. Therefore, a wise trader always utilizes Time as a guidepost, combining it with Price and Pattern to make informed trading decisions.

Pattern: The Fine Thread That Holds It All Together

In WD Gann’s trading universe, Patterns play a Pivotal role. They help us understand the correlation between Price and Time or, in simpler words, how Price and Time work together in trading the markets.

The patterns that Gann explained in his books and courses are not merely random market fluctuations. These patterns are different and simpler to understand than traditional technical analysis patterns. Instead, they are widely recognized ways that offer valuable insights into the Market’s underlying behaviour.

Though Gann used Geometric shapes in his trading methods, the core idea can be simplified by focusing on the fundamental principles of symmetry and proportionality that lay the foundation.

The same Laws of Nature, also known as Natural Laws, also apply to Patterns. On a deeper level, these patterns are subject to the same Natural laws that govern the universe, offering insight into the fundamental principles that guide our world.

The Confluence of Price, Time and Pattern in Trading

The combination of Price, Time, and Pattern offers decisive turning and trend-reversal points where one can discover multiple opportunities.

When these three factors come together, it creates a Powerful confluence point, like a crossroads where three mighty rivers meet. Each element brings unique characteristics, and its meeting point offers the ideal conditions for highly Rewarding trading opportunities.

As a trader, it is essential to identify these correlated zones on your trading charts. These are the situations where your analysis pays off, providing the most profitable trading opportunities.

What is the One thing You can do Today to Improve your Trading skills?

Start by understanding how these Three factors of markets- Price, Time, and Pattern – work together.

Price isn’t just a Number. It indicates what market participants and traders think and feel about market sentiments and trends. By looking at prices, you can get clues about whether they are greedy or fearful.

Next, don’t forget about Time. It helps you understand how long a trend could last and when it might change direction. A simple combination of ‘Time’ and ‘Price’ significantly improves your trading results.

Lastly, pay attention to Patterns. These are like the signposts that help you understand how price and time are linked and give you hints about what the market might do next.

Price, Time and Pattern can transform how you see the markets. They won’t make you trade more—they’ll help you trade better.

The best part? You don’t need complicated indicators to use them. You need to start seeing what most traders overlook.

Make it a habit. And over time, it will become your biggest edge. – Divesh.

Going Beyond the Basics Starts Here

If you’re serious about truly understanding how Price, Time, and Pattern work together in the markets—beyond what’s commonly shared online—then our courses are for you.

Our course doesn’t teach surface-level concepts and methods.

We study the underlying principles behind market movements, the principles that Gann used to make his trading decisions.

From timing key reversals to pinpointing meaningful price levels and repeating patterns, you’ll learn how to apply these strategies to real-world trading, not just study them.

If you’re serious about learning and this is what you’re looking for—exclusive, strategic-level trading knowledge, then feel free to email me at [email protected]. I’ll be happy to help you.