The Hidden Order

A Rule-Based Mathematical Trading System That Reveals The Hidden Order Behind Market Moves

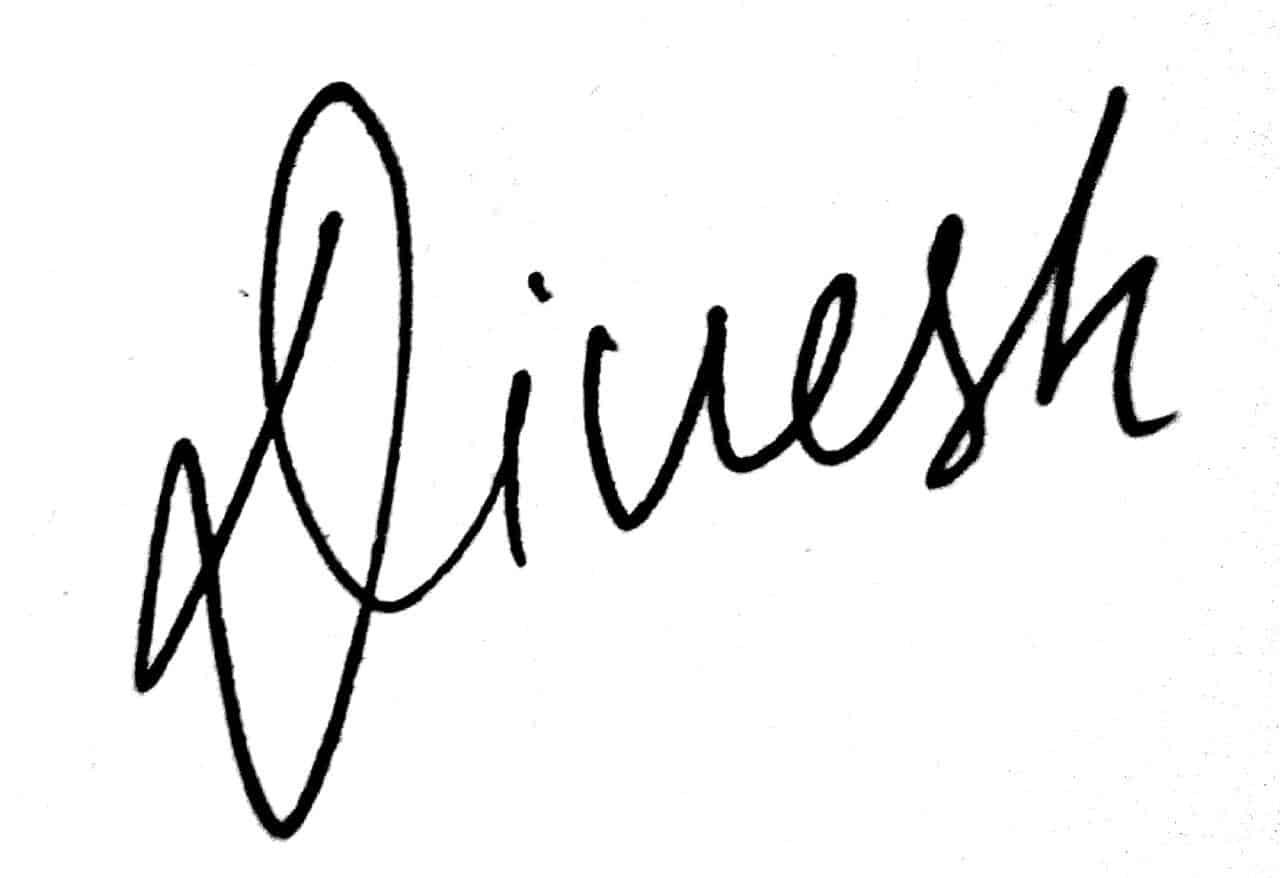

Why Your Trading Wins Still Leave You Empty-Handed

You win trades, but your account still doesn’t grow. One day you catch a good move, the next day the market takes it all back.

It starts with your entries. You see a move, jump in, and hope for the best. Sometimes it works, but most of the time it doesn’t. And even when it does, it feels like luck, not skill. Random entries always produce random results.

Then come the exits. You book profits too early out of fear, or you hold on too long, hoping for more. Stop losses get shifted or ignored, and the market takes back more than it gives.

And when it comes to growing your account trading capital, position sizing is the blind spot. You win small when you should press harder, and you lose big when you should stay light. After weeks of effort, your account looks the same—or worse.

Frustration rises when you trade intraday or short-term swings. Quick moves and reversals come one after another. Without rules, these moves turn into traps. You end up chasing trades, missing exits, and taking losses that feel sudden and unfair.

This is the gap most traders never close. You keep chasing tips and trying new indicators, while ignoring the deeper foundation—the same one WD Gann built his work on. He succeeded because he built his trading on mathematical principles linked to natural laws—principles that never change, and they work just as well today as they did a century ago.

That foundation is missing in the way most traders approach the markets today. And without it, consistency will always stay out of reach.

Introducing: The Hidden Order

A Rule-Based Mathematical Trading System That Reveals The Hidden Order Behind Market Moves

That’s where everything changes.

The missing piece isn’t another indicator or shortcut. What you need is a rule-based framework that tells you exactly where to enter, where to exit, how much to risk, and when to adjust size. Once those rules come together, your trading stops being random and starts being consistent.

That’s what The Hidden Order gives you. It’s a complete trading system inspired by WD Gann’s core ideology—built on numbers, mathematics, and natural laws that never change. These principles reveal the structure hidden within market movements, allowing you to see order where most traders only see chaos.

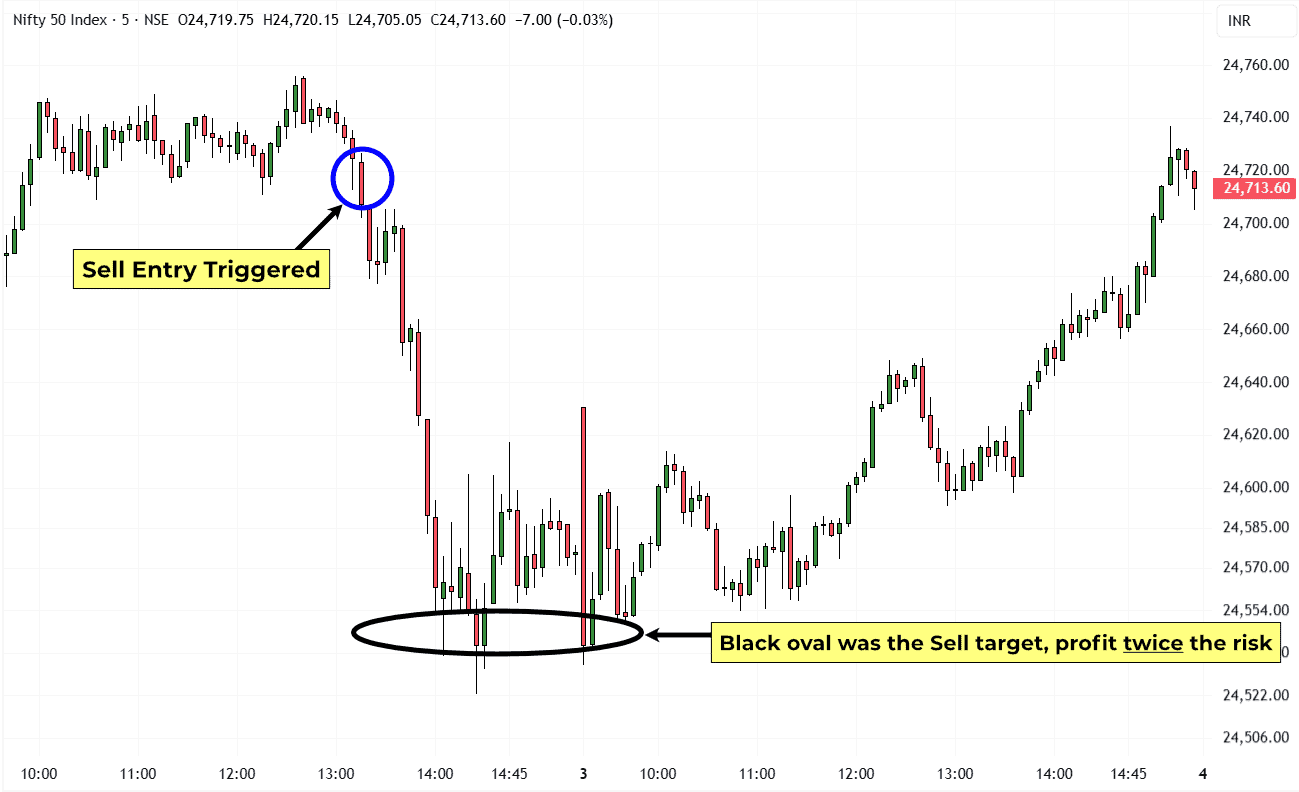

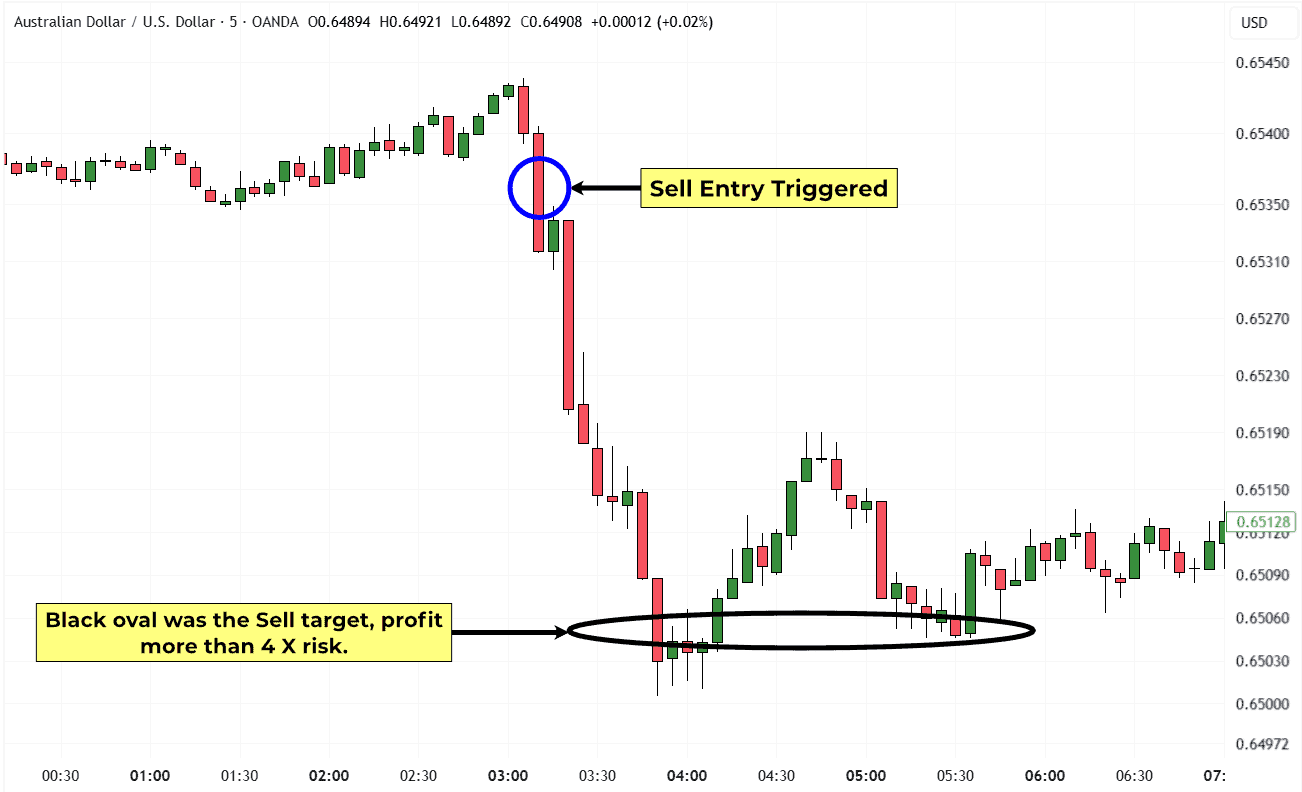

With this approach, you don’t just find buy and sell trades—you know the exact points to act. You know your targets and stops before the trade even begins. You know how to size positions so wins actually grow your account while losses stay controlled.

It works exceptionally well for intraday and short-term swing trades, where speed and clarity matter most. Instead of chasing, you trade with calm confidence—because every decision is guided by rules, not guesswork.

The end result is simple: continuous growth, fewer mistakes, and a dependable trading edge you can trust.

You’re no longer at the mercy of sudden swings. You’re trading with the same foundation WD Gann relied on—mathematical principles tied to natural laws that remain as reliable today as they were in his time.

Here’s What Students Say About Our Past Courses.

This is our newest course release, but here’s what traders have said about our previous courses.

“Why should I trust another stranger on the internet selling Gann secrets?!”

Your website looked very interesting, especially to someone who studies Gann. But before purchasing the course, I had two concerns.

One, I didn’t know you personally, so I wasn’t sure what to expect.

Two, I wasn’t sure how the international payment would go.

I’m really glad I went ahead anyway—the course turned out very useful, and the payment process was easy.

Now I finally understand what Gann meant by the Law of Vibration.

Before this course, I was never fully confident that I understood that concept. It always seemed unclear. After going through your course, it clicked. I now feel sure about what Gann was really saying.

That question—“Why should I trust another stranger on the internet selling Gann secrets?”—was on my mind before I joined.

However, after studying the course, that doubt quickly faded, and what I learned gave me the clarity about Gann’s work I had hoped for.

The timing methods are practical and reliable.

I liked how precise and repeatable the techniques are. I tried them on different timeframes and got similar results to those you showed in the course, which gave me a lot of confidence.

I’m even using it to forecast prices.

You briefly mentioned that these timing tools could also help with price forecasting. I tested that out, and it’s already working for me. With more practice, I know it’ll get even better.

The Hidden Market Timing Principles of WD Gann is a must for any Gann student or trader. I’m now entering trades much closer to the actual turning points. That’s a huge shift for me. Many thanks to you, Divesh.

– G.B. (‘The Hidden Market Timing Principles of WD Gann’ Course Student)

Here’s what You’ll Learn from this Course

How to Set your Stop and Target Right at Entry—so your risk and reward are fixed from the start, and you secure profits before the market turns.

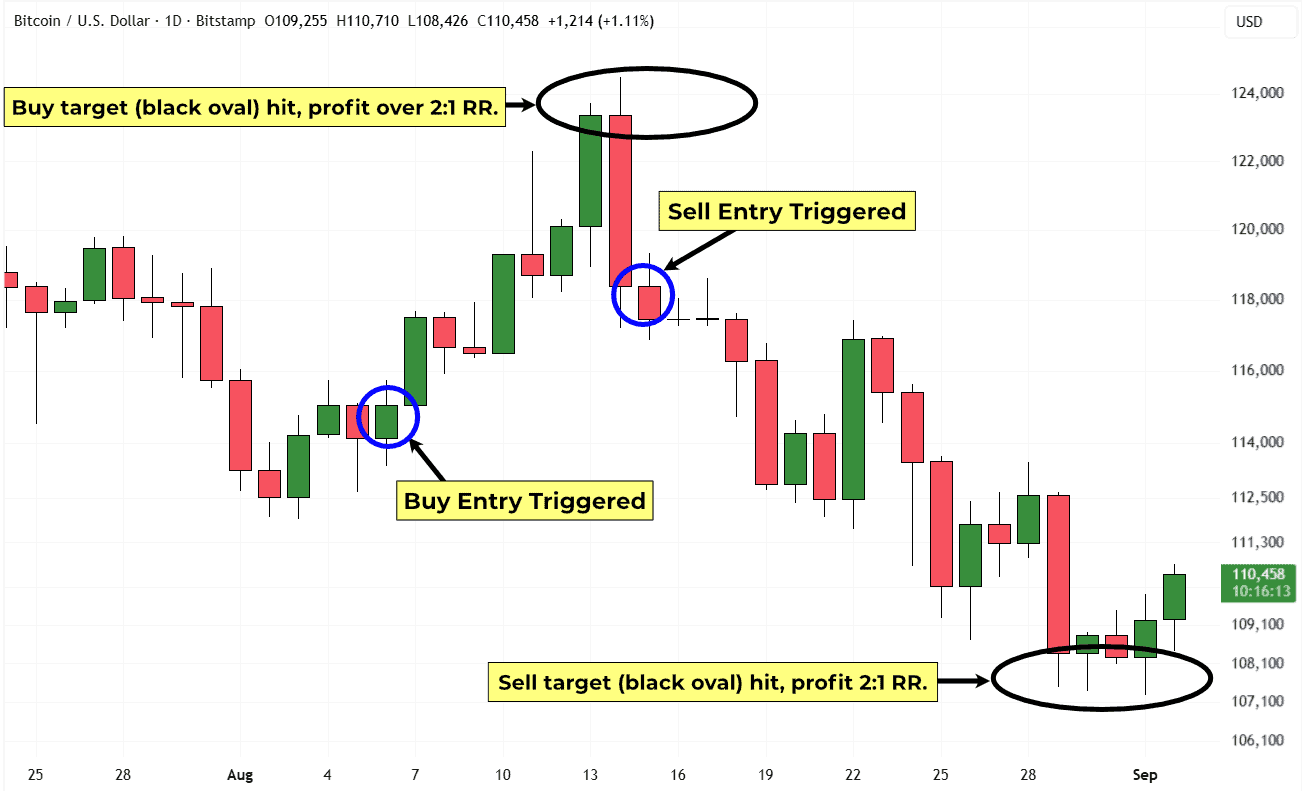

How to Measure trades in Simple Risk-to-Reward terms—so you always know the balance between risk and possible gain.

How to Manage Risk with clear stop-loss rules and a Simple trailing approach—so a losing trade stays small and controlled.

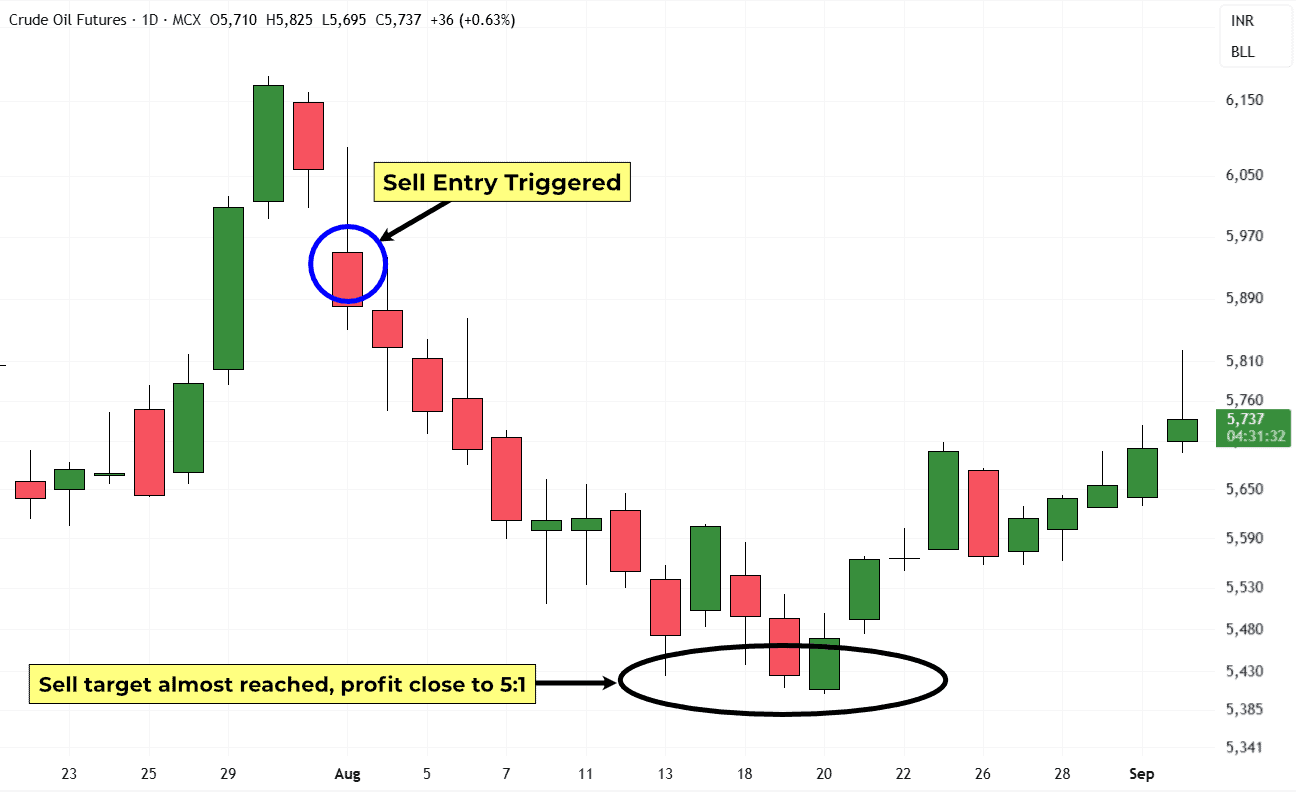

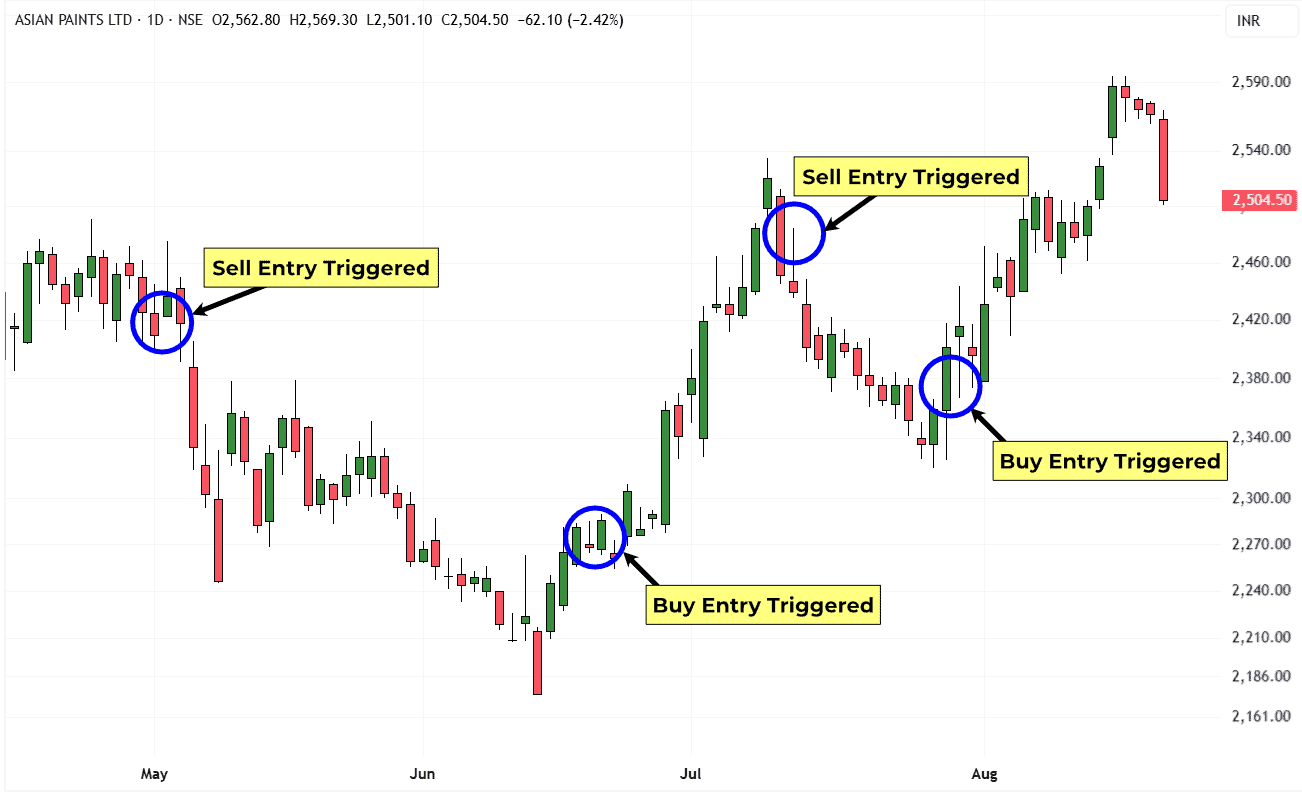

How to spot Buy and Sell points with rules that cut out hesitation—so you act at the right moment instead of running behind the move.

How to Size positions with discipline—when to stay small, when to add, and how to keep overall risk under control.

How to tie entries, exits, and sizing into one Rule-based process—so every trade pushes toward real account growth.

How to Apply the method across all timeframes—from quick Intraday movements to Daily, Weekly, Monthly, Quarterly, and even Yearly swings.

How to trade Extended Moves—so stops keep risk controlled even when the price continues pushing.

The Core Principles WD Gann built his trading on: universal laws of mathematics and nature that don’t change—working a century ago, working today, and working tomorrow.

Here’s What Students Say About Our Past Courses.

This is our newest course release, but here’s what traders have said about our previous courses.

“I had zero trust in trading mentors, but Divesh’s courses proved me wrong”

The biggest reason I hesitated before joining was simple—I didn’t know who to trust. In the world of stock market education, genuine mentors are rare. But right from the start, Divesh Sir stood out. He shares real, practical knowledge, not fluff—and that alone built immediate trust

I enrolled in two courses—Beyond the Noise and The Hidden Market Timing Principles of WD Gann—and the experience was way beyond my expectations. Both courses felt fresh, insightful, and most importantly, logical. The concepts were crystal clear and took the guesswork out of my trading completely.

The top three benefits I gained? Confidence, Patience, and No Guesswork. And that first one—confidence—is something not everyone builds so quickly. But with Divesh Sir’s methods, the more I practised, the stronger that confidence became.

I highly recommend these courses to anyone serious about trading as a profession. The value is far greater than the fee, especially if you’re committed to learning the right way.

– Y.R. (‘Beyond The Noise and Market Timing Principles’ Course Student)

Frequently Asked Questions

You have questions, and we have answers.

Yes, the concepts explained in this document are easy to learn. It can be used by traders, regardless of their background experience in trading.

There is no need to have any specific software.

As long as you’ve access to any Trading software or to any websites from which you can access charts, you can use it.

In fact, you can even Print the chart and still be able to use the knowledge on the printed chart.

It’s a huge Myth, and it’s totally Wrong.

You don’t need to know anything about Astrology. All you need is a chart, and you should use it as our course material suggests.

These concepts are based on Natural Universal laws and Mathematics. And they will continue to work forever.

It’s like 1+1=2. Will this equation change after 20,40, or even after 100 years? No, because it’s based on mathematics.

It’s the same with all the methods which we teach. They can be learned once and can be used forever.

No, the course content explained will work on all charts—be it stocks, futures, currency, or commodities. It can be used on all time frames, ranging from 5-minute charts to 1-month charts.

We have students from different trading backgrounds. Some of our students are day traders, and some of them are swing traders. Some trade stocks, some trade futures, and some trade commodities.

But our concepts/methods can be applied on any chart and in any timeframe, regardless of your trading style.

You can read the contents of the course in a couple of hours.

But after reading, I suggest you practice them on charts for at least 3-6 months to solidify your understanding of the concept. Once you are confident, you can start taking real trades.

The success percentage of the method is good. But there is no direct answer, like 80% or 90%.

It’s the trader’s responsibility to take all the trades whenever there is a signal. And also to have an understanding of the Probabilistic nature of trading – where we are looking to profit from a series of trades.

For example, the first three trades might result in small losses, and then the fourth or fifth trade might be a big winner.

What if the person doesn’t take the Fourth and fifth trades due to fear?

Then, people start to blame the concept/method rather than trying to understand the game of trading, which is to take all the trades as given by their method.

I suggest students understand the concept and take a minimum of 20 trades whenever there is a signal.

This will help you shift your focus from worrying about the method’s success percentage to profiting from a series of trades.

The course fees are high because all these courses/methods are the result of 20+ years of research into Gann studies.

They are uniquely designed and Original and cannot be found anywhere on the Internet for free or for a fee.

Why you should consider investing in the course now?

There are two reasons.

Your goal is to become a professional trader: I know many people who try out “trading” without putting in serious work.

And no wonder they lose their money in a short amount of time and quit trading completely. Our courses are not designed for these people.

The intention behind these courses is to really make you a professional trader – who is serious about putting in the time, money, and effort.

If you approach trading from this angle – to become a professional trader, then these course prices are relatively reasonable and affordable.

People spend a couple of lakhs in engineering, medicine, etc, because they are highly aware of the benefits that they’ll reap later.

It’s the same with trading as well. If you invest in the right source, a few years down the line, you’ll be able to reap the rewards, and you’ll be happy that you took the decision for yourself.

Course prices might increase in the future: The price of our courses might increase in the future due to their uniqueness and the limited copies we sell each year (we sell only #5 copies of this course in a year). So you might consider investing now, then waiting for the future.

We don’t offer any Money-Back Guarantee.

But we guarantee 100% satisfaction with trading knowledge through our courses, which you cannot find elsewhere, either online or offline.

This alone gives you a unique advantage over other traders and separates you from the crowd.

If you have any questions/doubts regarding the content of the course, you can email me through www.transfernow.net (it’s free), and I’ll reply to your question within 24-48 hrs.

If you are still uncomfortable with the concepts, even after a couple of emails, I’ll arrange a one-on-one online session to solve your query and make you comfortable with them.

I won’t leave you alone after your purchase – it’s my responsibility to ensure that your questions are resolved and that you are clearer with the concepts/methods.

That’s also one of the reasons we sell limited copies (5 copies per year): so that we can give complete attention to students’ questions and help them out.

The support from my end is valid for one year from the delivery date of the course.

The support system is only strictly via email (through www.transfernow.net), and we don’t have any social media platforms for discussion.

What Makes The Hidden Order Different

The Hidden Order is a trading system built on Mathematical Principles and Natural laws that WD Gann relied on.

Most trading courses recycle the same things—indicators, chart patterns, or short-lived strategies. They look promising at first, but like every indicator-driven system, they fail as soon as market conditions change.

The Hidden Order is different. It isn’t built on indicators or opinions, but on the same foundation that WD Gann relied on: Mathematical Principles and Natural laws that don’t change.

It teaches fixed rules for when to enter, where to exit, and how much to risk—rules that work in fast intraday trades as well as for long-term trends.

That’s the advantage of The Hidden Order. It’s a practical trading system that doesn’t depend on trends or opinions—only on principles as reliable today as they were in Gann’s time.

How do I Buy this Course?

When you purchase any of our courses, you’re required to sign a Non-Disclosure Agreement with us not to share the course’s contents with anyone in any way or by any means.

Please do not consider investing in our courses if you are not willing to sign a Non-Disclosure Agreement (NDA) with us.

We sell only 5 (five) copies per year of this course. Our intention is not to cater to the Masses.

The GOAL is to offer it to a small number of traders who are interested in the Original trading work of WD Gann and want to understand the Truths of the markets more deeply.

What are the Steps involved in Purchasing this Course?

Below is the step-by-step process you need to follow to purchase this course.

Step 1: You need to send an email to [email protected] expressing an interest in purchasing this course.

Step 2: After that, you will receive a KYC form and Non-Disclosure Agreement (NDA) from our end, which you must fill in and email back to us.

Step 3: As soon as we receive your KYC form and Non-Disclosure Agreement (NDA), we will send you the bank account details for transferring the course fees.

Step 4: Once we receive your course fees, we’ll email instructions to download the course files to the email address you gave us in the Non-Disclosure Agreement (NDA).

The whole process is smooth, and I will be there to help you along the way. If you get stuck or need help at any point in the process, then please email me right away at [email protected] – I’ll help you as soon as possible.

Secure Your Copy of The Hidden Order

Special Introductory Price: ₹1,81,400 INR (approx. $2,150 USD)

The Course Booklet — a Protected digital PDF. Includes Lifetime Access and One Year of Personal Support.

The Hidden Order gives you a complete, rule-based trading system built on the Mathematical principles and Natural laws WD Gann relied on. You’ll know when to enter, where to exit, how much to risk, and how to size positions—across intraday, swing, and long-term trades.

Access is strictly limited. Only five copies are available each year. This is not a mass-market course.

If you’re serious about building consistency, this is your chance to learn a trading system that delivers the highest level of precision—one that provides a dependable trading edge.

Here’s What You’ll Learn from This Course

How to Set your Stop and Target Right at Entry—so your risk and reward are fixed from the start, and you secure profits before the market turns.

How to Measure trades in Simple Risk-to-Reward terms—so you always know the balance between risk and possible gain.

How to Manage Risk with clear stop-loss rules and a Simple trailing approach—so a losing trade stays small and controlled.

How to spot Buy and Sell points with rules that cut out hesitation—so you act at the right moment instead of running behind the move.

How to Size positions with discipline—when to stay small, when to add, and how to keep overall risk under control.

How to tie entries, exits, and sizing into one Rule-based process—so every trade pushes toward real account growth.

How to Apply the method across all timeframes—from quick Intraday movements to Daily, Weekly, Monthly, Quarterly, and even Yearly swings.

How to trade Extended Moves—so stops keep risk controlled even when the price continues pushing.

The Core Principles WD Gann built his trading on: universal laws of mathematics and nature that don’t change—working a century ago, working today, and working tomorrow.

Important details

If you have any payment issues, please email [email protected] – I’ll help you as soon as possible.

As soon as your payment is complete, you’ll receive an email with instructions regarding accessing the course in secure PDF format.