Imagine entering a crowded auction where bidders whisper, hands rise, and prices fluctuate rapidly. Some buyers increase their bids with confidence, while others hesitate, waiting for a better deal.

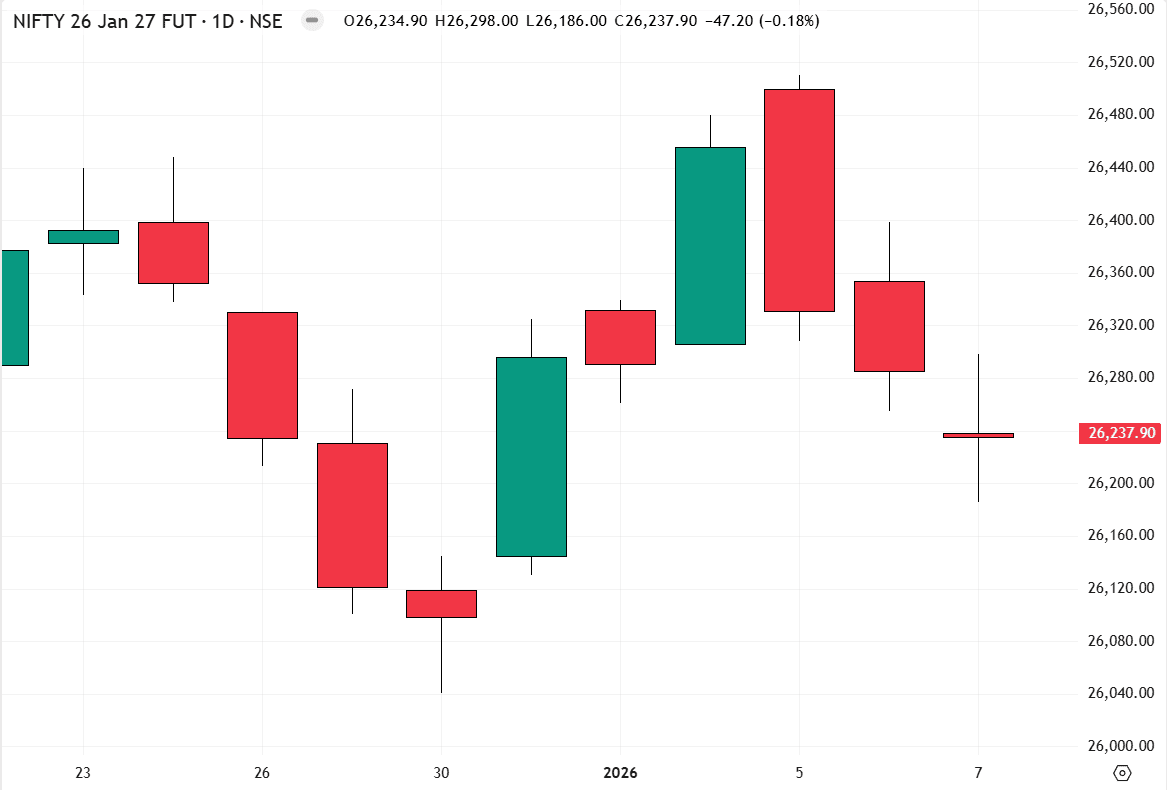

The stock market works the same way, except instead of voices, price movements tell the story.

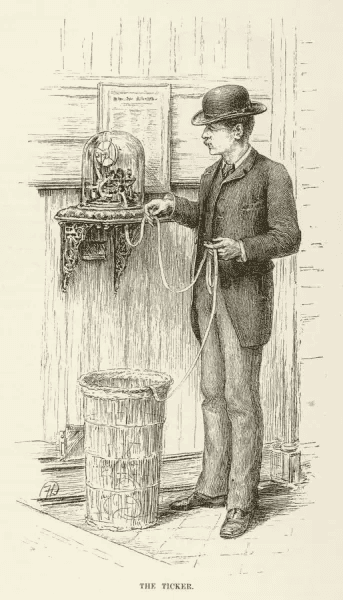

For decades, professional traders have used tape reading to understand market price movements and market psychology.

However, the physical ticker tape of the past no longer exists. Yet, the principles of tape reading remain just as relevant today.

WD Gann mastered this skill by analyzing price action, volume, and order flow to predict market moves.

Today, traders apply price action analysis, order flow trading, and volume-based strategies—all modern versions of tape reading.

This article explores how tape reading isn’t outdated—it has evolved.

Understanding market psychology, spotting accumulation and distribution, and identifying shifts in supply and demand are key to market success.

Whether you’re a day trader or a long-term investor, mastering tape reading can give you an edge in the market.

Let’s explore Gann’s timeless principles of tape reading and examine their continued influence in modern trading.

What is Tape Reading?

In its simplest form, tape reading is the study of price movement.

Before modern digital charts, traders relied on ticker tapes—machines that printed stock prices in real-time—to track the market.

In his book Truth of the Stock Tape, Gann describes tape reading as the process of identifying whether stocks are being accumulated (bought in large quantities) or distributed (sold off by major players) before significant market moves occur.

Gann stated, “The tape tells the truth if you can interpret it correctly.”

In simple words, the market gives signals before big moves happen, but only those who know what to look for can identify them.

Unlike many modern traders who rely heavily on news or indicators, Gann believed that price action alone reveals the market’s true state. He emphasized the importance of tracking the trend of buying and selling rather than reacting emotionally to headlines.

The Market Reflects Human Behavior

Markets are more than just numbers—they reflect human emotions.

Prices fluctuate because thousands of traders act based on fear, greed, confidence, and uncertainty. Every market movement tells a story of collective psychology.

Market psychology plays a crucial role in trading, just as much as technical analysis. WD Gann found that certain emotional patterns repeatedly influence market movements:

When prices rise quickly, greed takes over, and traders rush to buy.

When prices drop sharply, fear sets in, and traders panic-sell.

When prices move sideways, traders hesitate, uncertain about the next move.

Because human emotions repeat over time, market patterns do, too. By studying price action and recognising these emotional cycles, traders can identify changes in the market early.

Why Most Traders Misinterpret Market Moves

Most traders lose money because they react emotionally to price movements instead of analyzing market trends objectively.

They follow crowds, news, rumours, and tips instead of analyzing what the market itself is saying.

Gann warned against relying on external opinions:

“Speculators and investors who simply guess, follow tips, rumours, newspaper talk, and so-called ‘inside information’ have no chance of ever making a success.”

By the time news reaches the public, the market has often already reacted. Professionals buy when the public is scared and sell when the public is overly optimistic.

That is why tape reading is so powerful.

Instead of relying on external opinions, one should develop independent thinking and a deep understanding of price movement by observing the market’s natural rhythm, rather than following the crowd.

Developing a Tape Reader’s Mindset

Successful tape reading requires watching the market without bias.

Gann believed that a trader’s greatest skill is the ability to remain objective and let price movements reveal the real story.

Here are three key principles to develop a tape reader’s mindset:

Observe without bias: Do not approach the market with a fixed opinion. Let the tape (price action) reveal the truth about the trend.

React to price, not news: If the price action contradicts the news, trust the price. The market often moves ahead of public information.

Stay patient and disciplined: The best trades are not always obvious at first. Learn to wait and watch how the price behaves before making a decision.

The market speaks through price movement, momentum shifts, and volume changes. Traders who learn to recognize these signals stay ahead of those who rely on external factors.

The secret is not predicting but understanding what the market is revealing in real-time.

Tape reading is a powerful skill, but Gann’s work didn’t stop there. What if the key to understanding market movements had been hiding in plain sight all along?

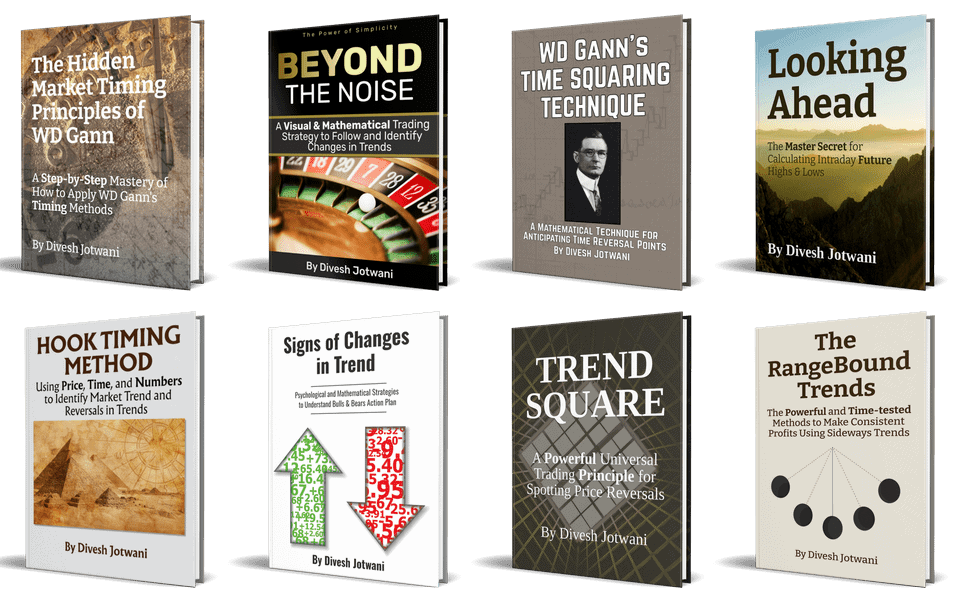

If you truly want to uncover the inner workings of the market and WD Gann’s original trading methods and strategies, then take a closer look at our courses.

You’ll find them 1000 times more valuable and practical than most traders are using today, or what you’ve been taught.

Conclusion: The Journey of Mastering Tape Reading

Tape reading is not a formula but a skill one can develop through experience and deep observation.

WD Gann believed the market rewards those who study it with an open mind, free from emotions and external noise.

As you continue your trading journey, remember that the market’s story is constantly unfolding. The key to mastering it lies not in complexity but in the ability to watch, learn, and act with precision.

Frequently Asked Questions About Tape Reading & Gann’s Methods

What is tape reading in trading?

Tape reading is the practice of analyzing price action, volume, and order flow to understand market movements and identify trading opportunities.

How did WD Gann used the tape reading?

Gann used tape reading to identify accumulation and distribution phases and spot price patterns and anticipate trend reversals as they occur.

Is tape reading still useful in modern markets?

Yes! Although digital platforms have replaced ticker tapes, the principles of tape reading are still applied in price action trading and order flow analysis.

Can tape reading be used without indicators?

Yes, traders can rely purely on price action and volume to analyze the market without using technical indicators.

How can traders develop a tape reading mindset?

By focusing on price action, avoiding emotional reactions to the news, and developing the patience to observe how the market moves before making decisions.