Trading success isn’t about luck or guesswork.

It comes from having the proper knowledge and tools to read market trends confidently. Without a reliable, rule based trading method, traders often react too late or make decisions they regret.

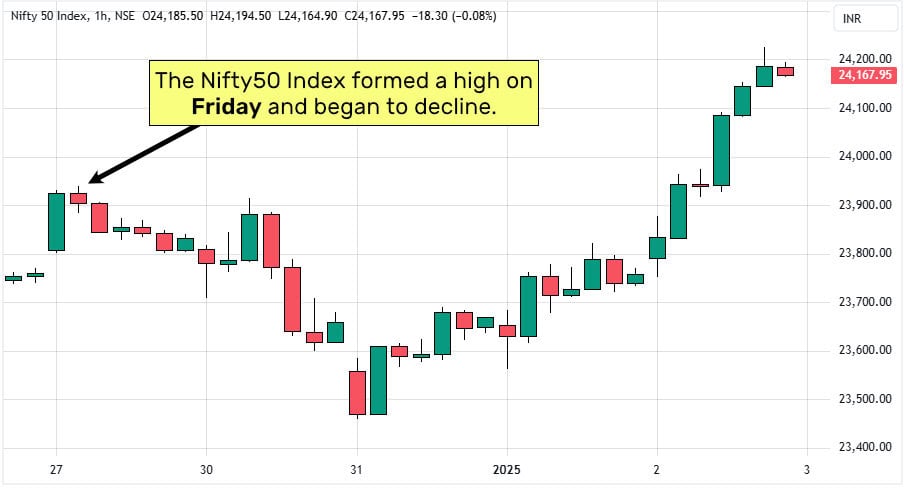

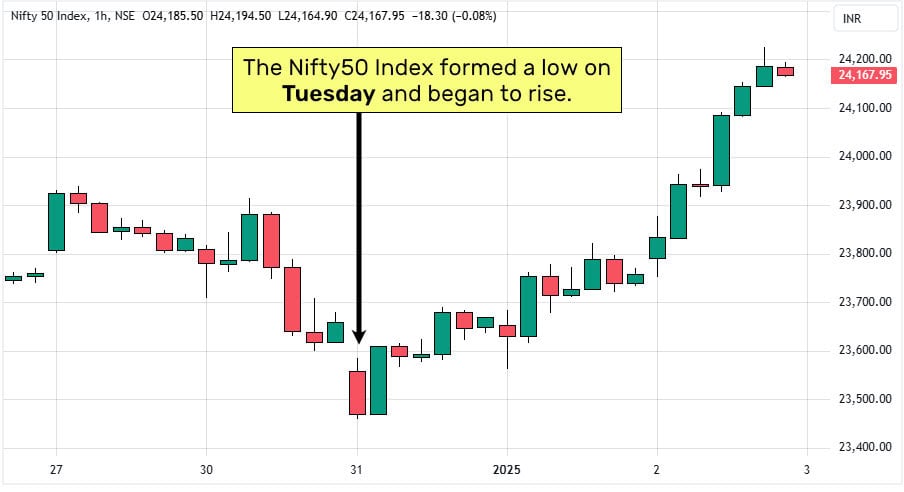

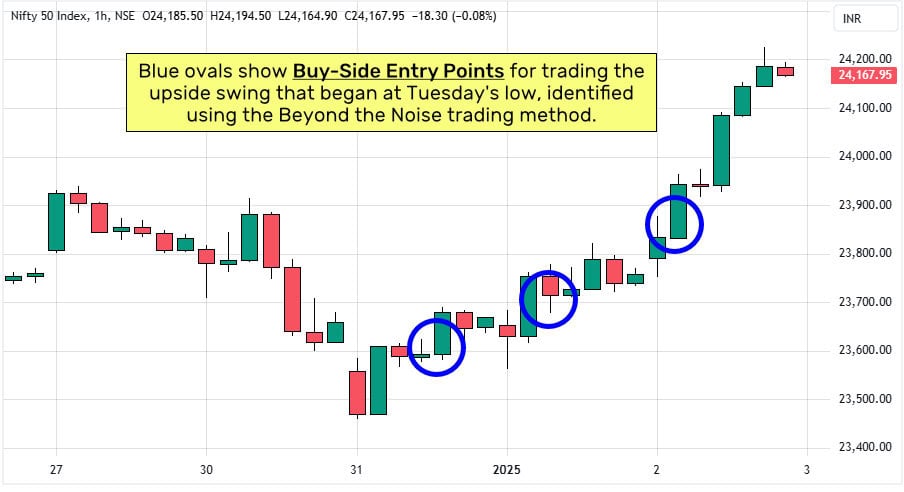

This week’s movements in the Nifty50 again confirm the importance of the skill of identifying and following changes in market trends.

A Real-Time Lesson from the Markets

Last Friday, the Nifty50 began to decline.

The drop continued until Tuesday, when it hit a significant low. Many traders were unsure about what to do next. Would the fall deepen, or would the market recover?

By Tuesday afternoon, the market reversed sharply. Over the next three sessions, the Nifty50 rallied more than 700 points.

This was confusing and frustrating for traders without a clear strategy. But it was an opportunity for those with a solid, rule-based method to act confidently.

They didn’t need to guess the rally ahead of time. They recognized the shift in the trend and followed it.

Why a Reliable Rule-based Method Trading Method Matters

Prices rise, fall, and sometimes swing unpredictably. Without a clear, powerful and reliable trading approach, these movements can feel overwhelming.

But with a reliable rule based Trading method, you don’t need to guess or react emotionally. You can read the market objectively and respond to what it shows you.

A strong method isn’t about predicting the future. It’s about understanding the present and acting decisively at the right time.

That is where Beyond the Noise comes in. It doesn’t just help you filter out distractions—it helps you focus on what truly matters: the market’s trends.

Instead of reacting to every ripple, this approach shows you how to identify meaningful changes in the trend. With this clarity, you can trade with confidence, knowing your decisions are based on the market’s actual movements.

Think of it like following a river’s current. You don’t need to know where every ripple is going—you just need to recognize the direction of the flow and move with it.

What is a rule-based trading method?

It’s a trading approach that follows a set of fixed rules. These rules help you decide when to buy or sell, stay consistent, and avoid emotional mistakes.

Why is a rule-based trading method important?

A rule-based trading method provides a system and discipline to your trading. Instead of reacting emotionally to the market, you follow a clear set of rules, which is extremely helpful during volatile times.

How does a rule-based trading method help identify trends?

A rule-based method helps you identify the market’s direction by focusing on specific signals, such as price patterns or market behaviour. It makes it easier to know when a trend is starting or changing.

Can beginners use rule-based trading methods?

Yes, this is a great starting point for beginners. A rule-based trading method helps them a lot. It simplifies decision-making and provides a clear framework, which helps them understand market complexities.

How is a rule-based trading method different from discretionary trading?

A rule-based trading method relies on predefined rules to make decisions, while discretionary trading depends on a trader’s intuition or judgment. Rule-based methods are more consistent and less affected by emotional bias.

Can a rule-based trading method work in volatile markets?

Yes, a rule-based trading method works well in volatile markets. It helps traders stay disciplined and stick to their strategy, avoiding impulsive decisions triggered by sudden market swings.

What are the key elements of a successful rule-based trading method?

A successful rule-based trading method includes clearly defined entry and exit rules, risk management guidelines, and a focus on identifying market trends. These elements ensure consistent and disciplined trading.

Can a rule-based trading method help reduce trading stress?

Absolutely. A rule-based trading method removes guesswork by providing a structured approach, making trading decisions easier and reducing stress.

Is a rule-based trading method suitable for all markets?

Yes, rule-based trading methods can be applied to different markets, such as stocks, indices, forex, and commodities. The principles of trend identification and consistency are universal to all.

Trading doesn’t have to be a guessing game.

With a method like Beyond the Noise, you can eliminate uncertainty and clearly approach the markets.

When you confidently identify and follow trends, trading becomes less about fear and more about opportunity. And that’s where true success begins. – Divesh.

If you want to purchase or need more information about the Beyond The Noise course, then you can email me at [email protected]. I’ll be happy to provide you with all the details you need.