In the previous post, we explained why random entries cause random results. Entering trades without a plan makes trading purely a matter of chance.

But here’s the catch: even with good entries, many traders still struggle.

Why? Because what happens after entry decides if your account grows or shrinks.

That’s where exits come into play. And this is why most traders silently lose money. Not because exits need to be perfect, but because most traders handle them without a rational method.

They take profits too quickly out of fear.

They set random or unrealistic targets.

They move or ignore stop losses.

The truth is simple: no exit will ever be perfect. Targets, stop-losses, and trailing stops are not guarantees. They are just tools to manage risk and capture a fair part of the move. You won’t get every last point, and that’s okay. The key is to apply exits consistently in a way that makes sense across multiple trades.

When there’s no fixed method for exits, the damage builds slowly but steadily.

You cut your winners too early. You let losses grow bigger than they should. You might even win more trades than you lose, but your account still won’t grow—because poor exits cancel out the benefit of good entries.

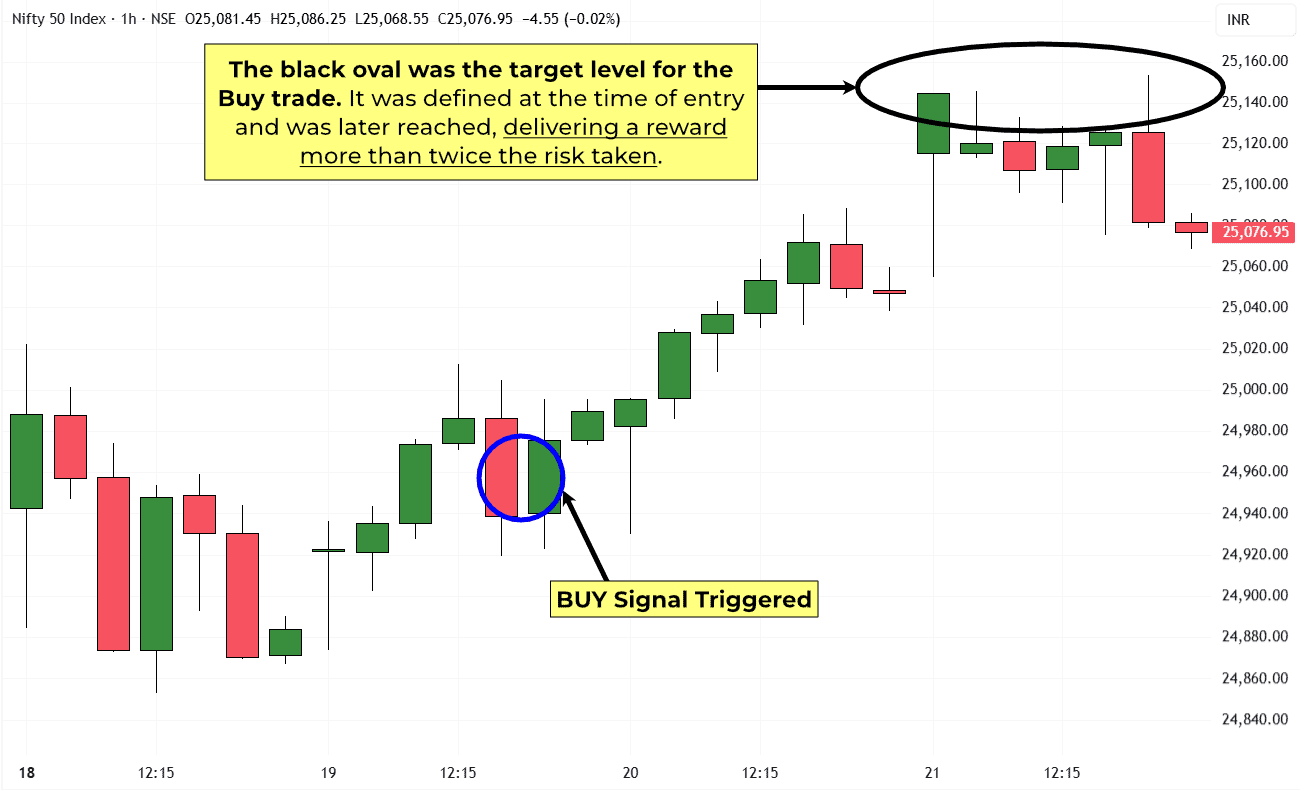

Take this recent Nifty example (Hourly Time-Frame):

On Tuesday, around 11:15 am, Nifty gave a Buy signal. After that, the market didn’t move straight up. It went sideways into Wednesday morning and even pulled back a little.

This is the point where many traders exit too soon—some take a small profit, others panic and close after the dip.

But with a clear exit plan, you would have stayed in the trade. By Thursday, Nifty moved higher and almost reached the target, giving more than double the reward compared to the risk (Risk: 1, Reward: >2). This is a clear example of risk to reward trading in action.

Without rules, most traders would have cut the trade early and missed the move. With rules, you could sit through the pullback and still capture the bigger profit.

The black oval represents the target area, calculated immediately when the Buy signal was triggered. The trade reached this zone, delivering more than twice the profit against the risk. It shows how risk to reward trading works when exits are planned in advance.

Think about your trades. Have you ever closed a trade for a small gain, only to watch the market run much further without you?

Or held out for a big target with no real plan, only to give back all your profit? Both come from exits based on feelings, not rules.

The Simple Fix: A Rule-Based Exit Process

It sets stops and targets based on the market, not hope.

It follows clear rules for when to book at a target and when to trail, so you don’t decide on impulse.

It measures results in profit or loss compared to the risk taken, so you know if the method is growing your account.

Exits aren’t about detecting tops or bottoms. They’re about taking a fair slice of the move repeatedly in a way that genuinely helps you grow your trading account over time.

But here’s the catch: even with strong exits, many traders still see their accounts stuck. That’s the part we’ll explore in the next post. – Divesh

P.S. These lessons show the problems. The solution lies in a hidden principle that separates professionals from the rest—and it will be revealed in my upcoming course.