Winning trades alone do not grow an account. Growth only occurs when trades are managed within a larger process.

That process is a proper trading system: it shows entries and exits and also guides you on when to stay light, when to step up, and when to protect capital. Without this structure, growth won’t last.

Even with solid entries and planned exits, random position size keeps the account unstable.

When you win big with a small size, the account barely moves. When you lose a large amount with a big bet, the account takes a hit that’s hard to recover from.

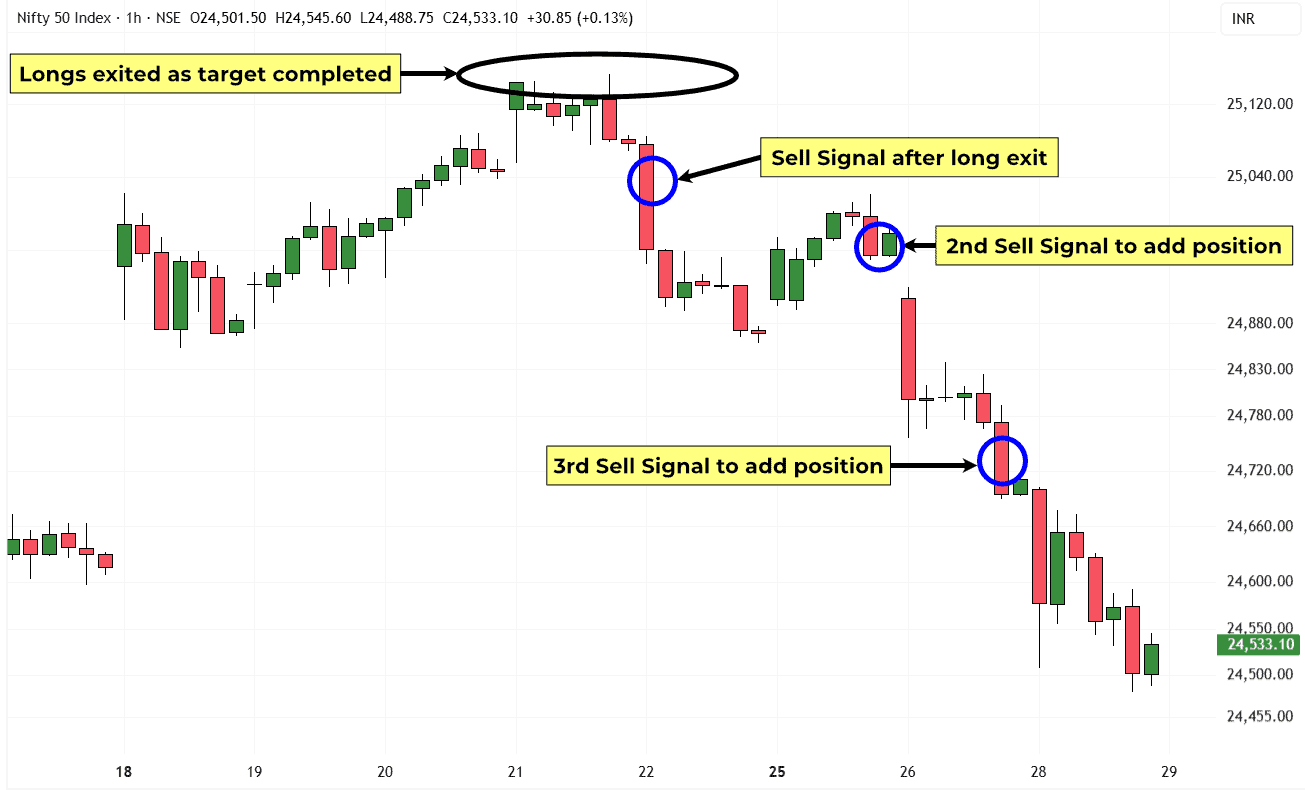

On the hourly Nifty chart, after the long exit signal, a short signal appeared. At that stage, a trader could have started with a small position.

When the next sell signal occurred, it was an opportunity to add while trailing the stop so total risk stayed no greater than the first trade.

A third sell signal confirmed the move further, allowing another add, again with the stop trailed to protect profits.

The key difference is sizing: add only as the downtrend confirms, with the stop guarding capital each time. That’s how an account grows while risk stays controlled.

This blind spot keeps traders stuck. They focus on the “next trade” and miss how trades connect to account growth through size and risk.

That is why many accounts fail to progress. Profits are cut too early or exits come too late, and when timing is right, size is wrong. The result is effort without real growth.

The principle is simple: growing an account is not about taking more trades. It is about taking the right trades with the right size, guided by rules that keep you consistent.

A proper trading system ties this together. It defines entries and exits and, more importantly, how much size to put on at each stage. That’s how steady growth is built.

Most traders fail to grow not because they cannot win, but because they miss the hidden principle of position sizing linked to account growth within a rule-based system.

P.S. Entries, exits, and sizing may seem like separate skills, but they’re connected through deeper natural laws and a mathematical structure. Almost unknown to most traders, yet it decides who stays stuck and who grows.

In my upcoming course, I’ll show you exactly how it works. Soon, you’ll have the chance to learn this whole unique one-of-a-kind trading system that brings it all together.