Let’s be honest.

Almost every trader, deep down, wishes they had a crystal ball.

Imagine knowing tomorrow’s market moves—what will rise, what will decline. It sounds like the ultimate shortcut to wealth—a guaranteed win.

For most traders, this pursuit of perfect foresight becomes an obsession. They chase every headline and jump on every rumour—just hoping to catch that one golden piece of information that’ll unlock endless profits.

But here’s the uncomfortable truth:

Even if you knew tomorrow’s news, it still wouldn’t make you rich.

In fact, it might just set you up for a blowup—especially if you treat that ‘perfect information’ as a guarantee.

Crazy, right? But there’s proof.

In a study by Elm Wealth (Crystal Ball Challenge), A group of 118 finance students was given tomorrow’s Wall Street Journal front page a full 24 hours in advance. Perfect information. A trader’s dream. You’d expect massive profits.

Yet, the results were shocking:

Half of them lost money. And 16% went completely bankrupt.

How?

They were right about the market direction more than half the time—51.5%, to be exact. So the predictions weren’t the problem. The core issue was their position sizing.

Feeling unbeatable with their “inside” information, they bet big. Some used extreme leverage. When they were right, they made money. But when they were wrong—just once—they blew up. One bad trade was all it took.

Now here’s where it gets interesting.

A second group, comprising just five experienced traders, ran the same experiment using the same news.

Their average return was +130%. A huge difference, right?

Why the vastly different results? Simple: they knew how much to risk.

They went small when things were uncertain. And they only bet big when the odds were high in their favour.

This experiment delivers a core lesson that’s often overlooked in the endless chase for market predictions: Even if you could predict the future, it wouldn’t save you from poor risk management.

Trading isn’t about being right all the time. It’s about surviving long enough for your edge to work. Most individual (retail) traders obsess over what the market will do next.

But the pros obsess over something else entirely: How much to risk when they’re right. And how to protect themselves when they’re wrong.

Because in the end, even a perfect prediction is worthless if one bad trade takes you out of the game.

Now, to be clear, prediction isn’t useless. Well-tested methods that help you anticipate key turning points can be valuable. However, they only work if combined with thoughtful planning, clear risk management, and a calm mindset. Most traders skip those parts, and that’s where the real trouble begins.

“Two Paths in Trading: Which One Are You On?”

So, if simply knowing the future isn’t the magic bullet, what is within your control as a trader? What should you focus on instead of chasing that elusive crystal ball?

Here’s What Actually Matters:

Always know your entry, exit, and stop-loss before you enter a trade. Have a clear plan. Not just where to get in—but where to get out, and where you’ll cut losses if things go wrong.

Know why you’re entering or exiting. What’s the reason? What setup or condition justifies the trade? Without that clarity, you’ll end up making impulsive moves.

Focus on spotting key turning points. Forget trying to guess every move. Instead, learn to recognise when and at which point a meaningful shift in trend is likely to occur, because those actions will help you grow your trading capital.

For example, look at the below Nifty50 Index daily chart. It shows where a recent major change in trend occurred. That was the signal at which you should have shifted your attention to exit longs and go short.

Take a look at more recent examples below. These charts were analysed using the same principles (methods) taught in the Trading the Universal Sequences course.

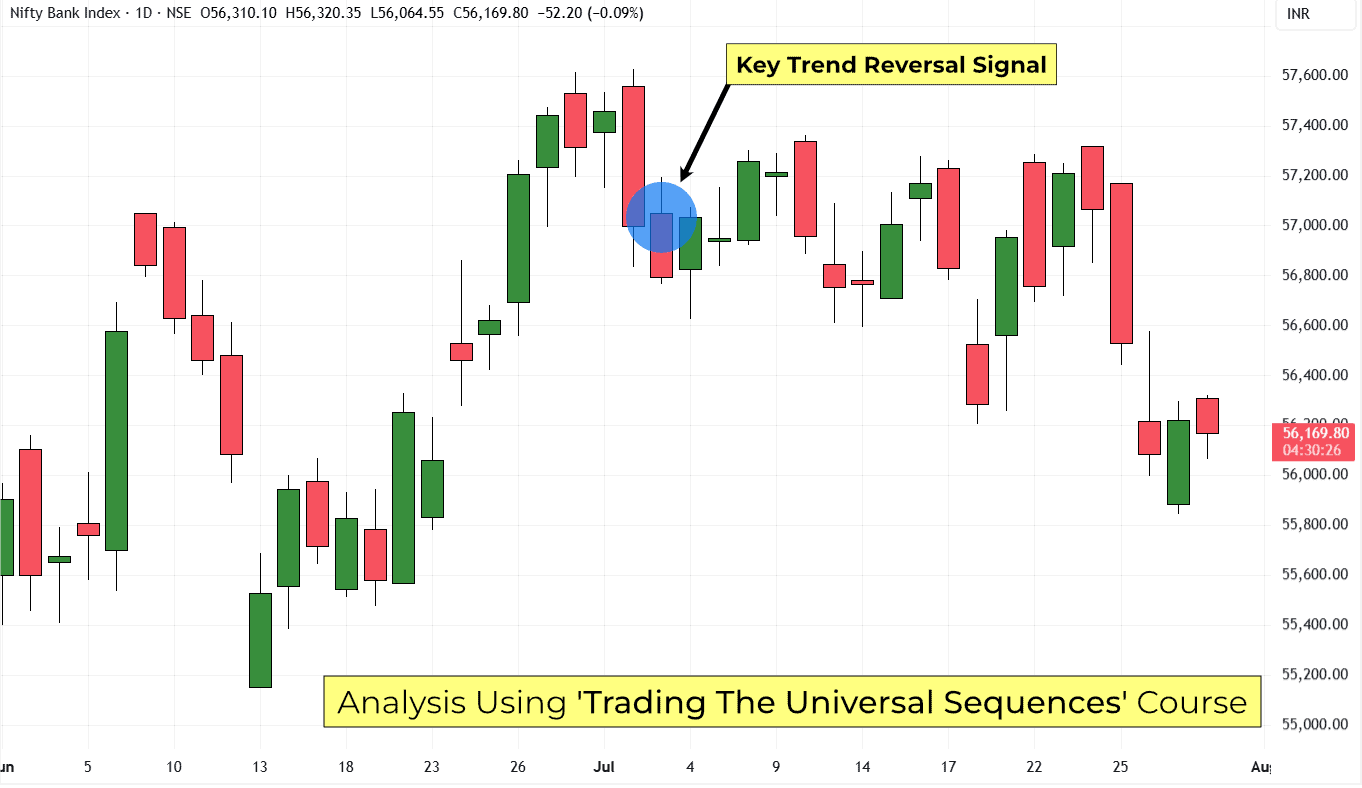

Bank Nifty: A clear reversal signal was generated right before the trend turned lower.

Reliance Industries: The method pinpointed the shift from bullish to bearish with remarkable clarity.

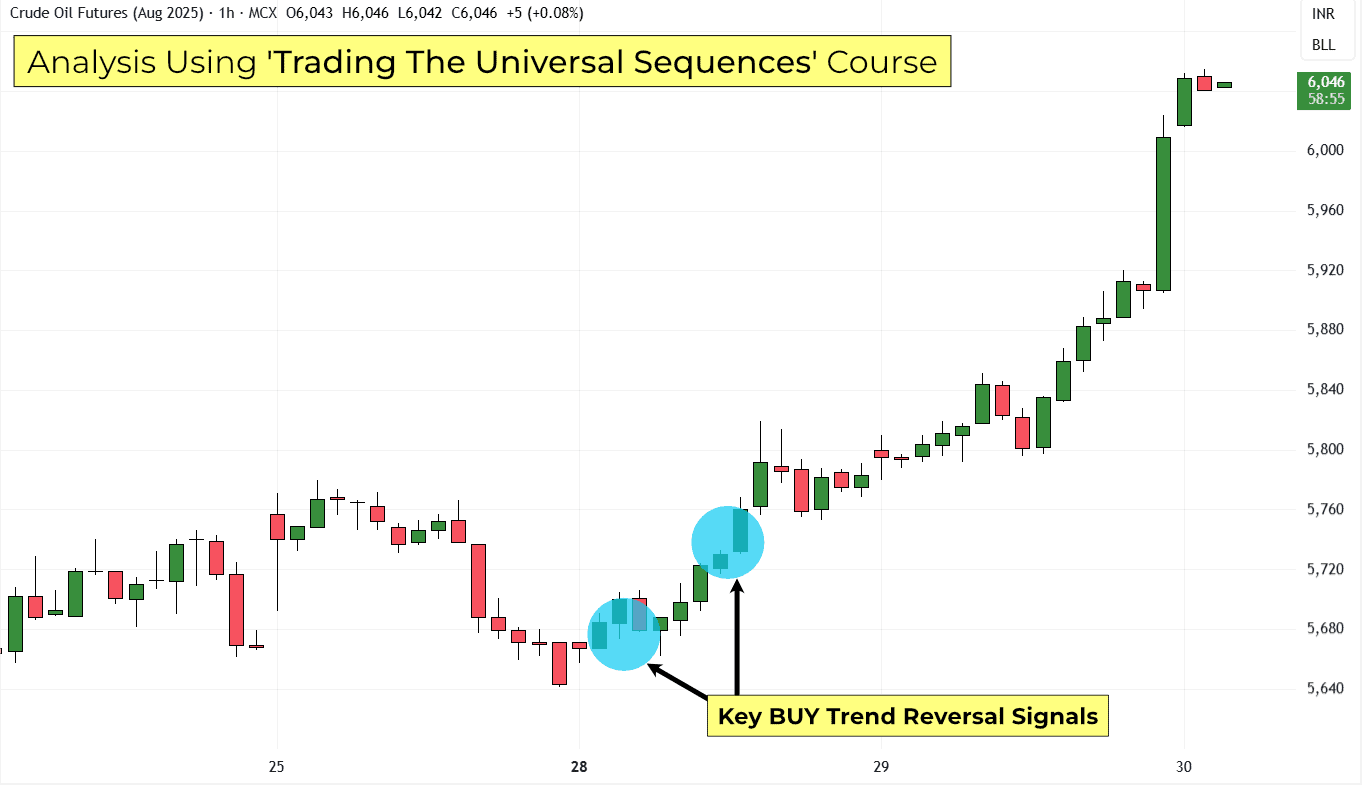

Crude Oil (Hourly): Multiple buy signals were captured before the strong rally that followed.

These aren’t cherry-picked. These examples show the clarity and accuracy the method delivers, whether you trade stocks, indices, commodities, or even cryptocurrencies.

Learning how to spot these shifts as they’re unfolding—not by guessing, but by reading the market’s structure—is what as a retail traders you should focus on.

That’s precisely what we teach in our newest published course, Trading the Universal Sequences. It’s built on mathematical principles to identify those powerful shifts in trends, without relying on guesswork.

Ultimately, sustainable trading isn’t about knowing every single future market move.

It’s about having a strong framework for how you will act, regardless of what happens, combined with strategic insights into potential market shifts. It’s about discipline, a clear strategy, and above all, intelligent risk management.

Let go of the dependency on that mythical crystal ball. The biggest lie in trading is that you don’t need to know the future.

The truth is, you just need to know your plan, manage your risk, protect your capital, and learn to identify key market opportunities. That’s the unconditional path to staying in the game and finding lasting profitability. – Divesh.

Ready to Master Disciplined Trading?

Our courses go beyond just spotting market shifts. They teach you simple yet powerful, practical, and systematic trading techniques and strategies based on logical market movements, to identify areas where the market is likely to pause or reverse.

In our more advanced courses, you’ll also learn powerful techniques to pinpoint key strong levels that show precisely where price has stopped before and where it might face pressure again.

This level of clarity enables you to plan your trades with precision, setting smarter entries and exits, managing risk effectively, and knowing when to stay on the sidelines until a real opportunity occurs.

Remember, this is not about guessing or making vague predictions. It’s about using precise analysis and an approach that helps you trade confidently in the market as it is, not as you wish it to be. – Divesh

Trading FAQ: Risk Management, Market Predictions, and Why Most Traders Fail

Why do traders lose money even when their predictions are correct?

Because prediction alone isn’t enough, even accurate forecasts can lead to losses if you’re trading with poor risk management. Without a clear trading plan (strategy) for how much to risk, where to exit, and how to protect your capital, a single mistake can wipe you out even if you’re right most of the time.

Why is risk management more important than being right in trading?

Because markets are uncertain, no one is always right. Risk management keeps you in the game when you’re wrong. It’s not about avoiding losses. It’s about surviving them. Over time, it’s your ability to manage risk—not your predictions—that determines long-term profitability and success.

What’s wrong with trying to predict the market using news or economic data?

Nothing. If you use it wisely. The real issue is traders who depend entirely on forecasts, thinking they’ll guarantee profits. In reality, markets often behave unpredictably, even after major news. The focus should be on how you’ll react to price movement, not trying to outguess it.

So if I shouldn’t focus on predictions, what should I focus on instead?

Focus on building or learning a rule-based trading method, understanding key market turning points, and using disciplined execution. Knowing where to enter, where to exit, and how much to risk on each trade will always beat chasing headlines or guessing market direction.