Every market move has a purpose — and a point where that purpose is complete.

Most traders miss it. They keep expecting more, even when the move has already done what it was meant to.

Finding that point isn’t about luck. It comes from understanding something very few traders ever study or apply.

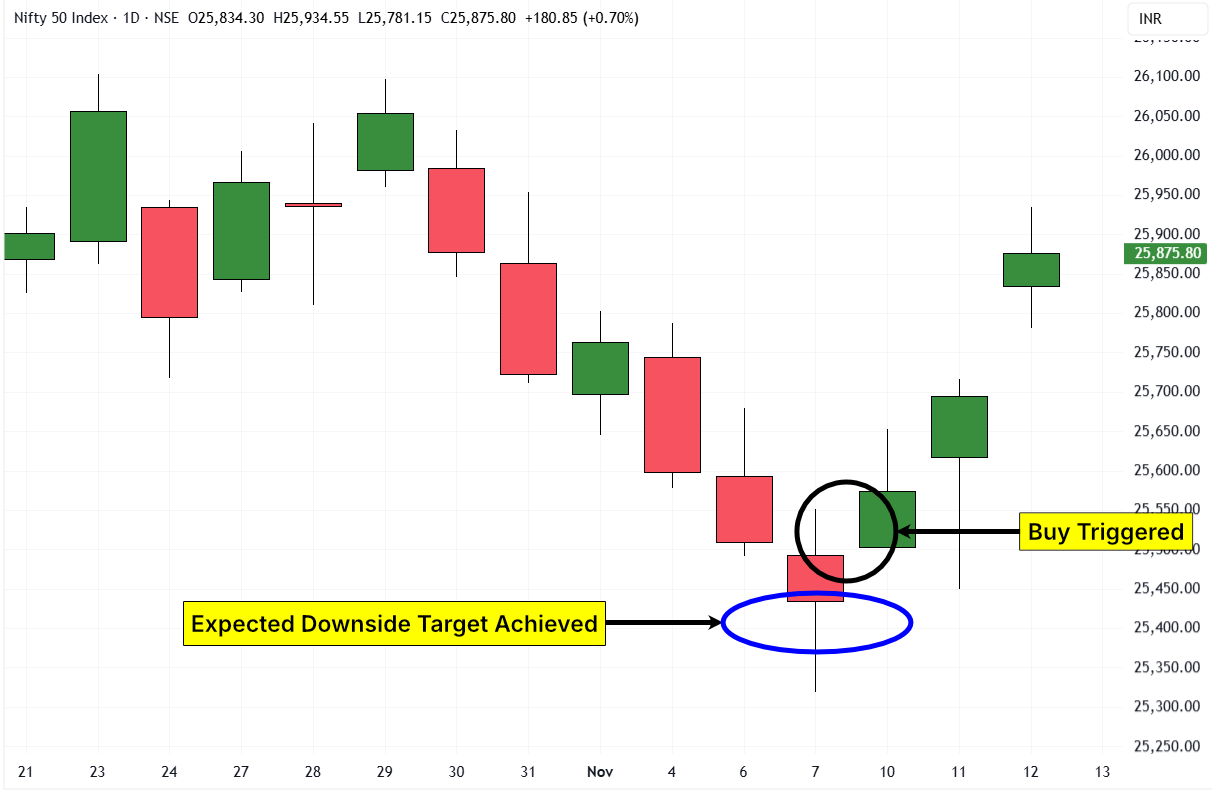

In the previous post, we saw how both Nifty 50 and Bank Nifty had reached a point where the uptrend was stretched and continuing higher had become risky.

Soon after, the market confirmed it with a Sell signal. Both indices hit the minimum expected target defined by The Hidden Order method — and right after that, reversed sharply upward.

That wasn’t a coincidence. It was the precision of a mathematical framework most traders never get to see in action.

This system shows both ends of a move — where it becomes high-risk to hold and where it’s likely to complete. That’s the point where continuation weakens and reversal often begins.

The principle behind this trading system originates from Gann’s work, which proves that every market move follows a natural mathematical order that still governs price today.

That’s the power of trading with a framework built on rules, not on guesses or emotions.

When your method defines both the entry and the natural end of a move, you start to see how the market really moves — and why.

That’s the difference between guessing and knowing.

And that’s what The Hidden Order is built to teach.

Few ever see the market through this lens — but once you do, it changes how you trade forever.

You can learn more about the Hidden Order Course by clicking here.

If you’d like to know more, you can reach me directly at [email protected].