Markets often tempt traders to think about what might happen next. But the real measure of a trade is not endless speculation—it’s whether the move you planned actually played out.

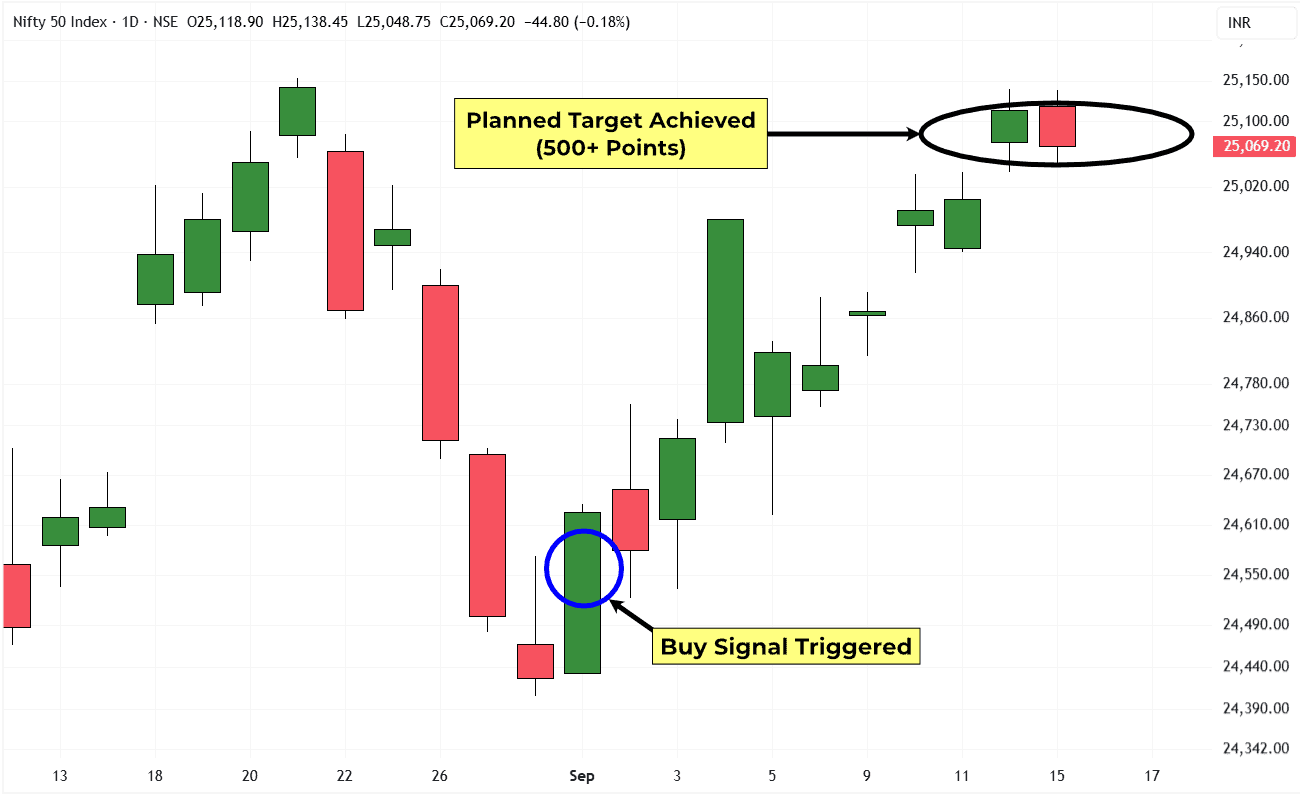

What happened in Nifty over the last ten days shows the above process at work.

A buy signal was triggered on the daily chart. The index then climbed steadily and went on to reach the planned target—more than 500 points from that entry.

Now, Nifty may still extend higher, which is always possible. But whether it does or not is beside the point. The fact is simple: the planned move is complete. Despite a couple of pauses, the move held and hit the target as planned.

That’s the point. The goal isn’t to forecast every turn but to follow a rule-based approach that guides a trade from entry to exit. The Hidden Order shows how rules make that work, so results aren’t left to chance.

P.S. What played out in Nifty is just a glimpse. The Hidden Order course teaches the entire method step by step. It’s the most important work (course) I’ve ever published to date.

You can learn more about this new course by clicking here.

If you’d like to know more, you can reach me directly at [email protected].