Most traders start with strategies, and that’s perfectly fine.

Strategies bring structure. They give you a plan. They help you take action with confidence.

But as you gain more experience, you begin to notice something deeper.

There are certain invisible lines in trading — quiet but powerful shifts — that start to matter just as much as the strategy itself.

You realise that beyond the setup, your ability to manage risk, align with momentum, and truly understand the market begins to shape your consistency.

These layers don’t replace your strategy — they enhance it.

They add strength to your decisions, clarity to your timing, and calm to your process.

It’s how you manage risk.

It’s how you align with momentum.

It’s how you develop the kind of insight that gives you clarity, not confusion.

Risk. Momentum. Unique Market Knowledge.

These often unseen factors quietly shape the difference between random gains and real growth.

Let’s break them down.

Risk Is More Than “How Much You’ll Lose”

Ask most traders how they manage risk, and you’ll hear the usual answers:

“I use a stop-loss.”

“I define my target in advance.”

But real risk management goes far deeper.

It’s not just about how much you can lose on a trade — it’s about handling the trade while it’s open. Are you locking in partial profits as the price moves in your favour? Are you trailing your stop to protect gains? Are you avoiding overtrading when the market is choppy?

True risk understanding includes knowing when not to trade, when to scale in or out, and when to stay on the sidelines. It’s also about managing emotional risk — the part where fear, greed, or revenge trading quietly work against you.

When you start seeing risk from these angles, your entire approach shifts. You become more deliberate and aware, and trading feels more in control.

Momentum – Ride the Wave, Don’t Fight It

One of the hardest things about trading is staying neutral enough to follow what the market is actually doing, not what you want it to do.

If momentum is clearly on the buy side, the opportunity is in long trades. If it’s on the sell side, your edge is in short trades. Simple, right? But many traders don’t act on this.

They hesitate, second-guess, or worse, they hold on to old positions out of pride or ego. “I’ll just wait for it to return,” they say. But the market doesn’t care about personal expectations. It only respects flow.

A flexible mindset is key. A good trader knows when to change their perspective, when to cut losses, and when to switch directions entirely, without emotional baggage. If you were wrong, it’s no big deal. Move on.

Momentum isn’t about guessing where the market will go. It’s about recognising where it’s already going — and having the clarity and discipline to align with it.

Unique Market Knowledge – The Edge Most Traders Don’t Have

Everyone has access to the same charts, tools, and news. So, what really gives you an edge?

The answer lies in building a unique market approach — something that sets your analysis apart. You must be able to spot patterns, timing, and behaviour that others overlook. That kind of clarity doesn’t come from using what everyone else is using. It comes from going deeper.

If your knowledge is just a copy of what everyone else is doing, you’ll keep getting the same results as they do.

To understand these layers, you need more than just a method.

It comes from staying curious, open, and committed to learning — not just once, but for life.

This journey isn’t for the faint-hearted. It’s for those ready to roll up their sleeves and keep evolving with the market.

So, how do you begin this deeper journey?

Learning a unique market knowledge that takes you beyond the surface and gives you a different perspective to see the market in ways most traders never do. One that opens your eyes to patterns, principles, and timings that others overlook.

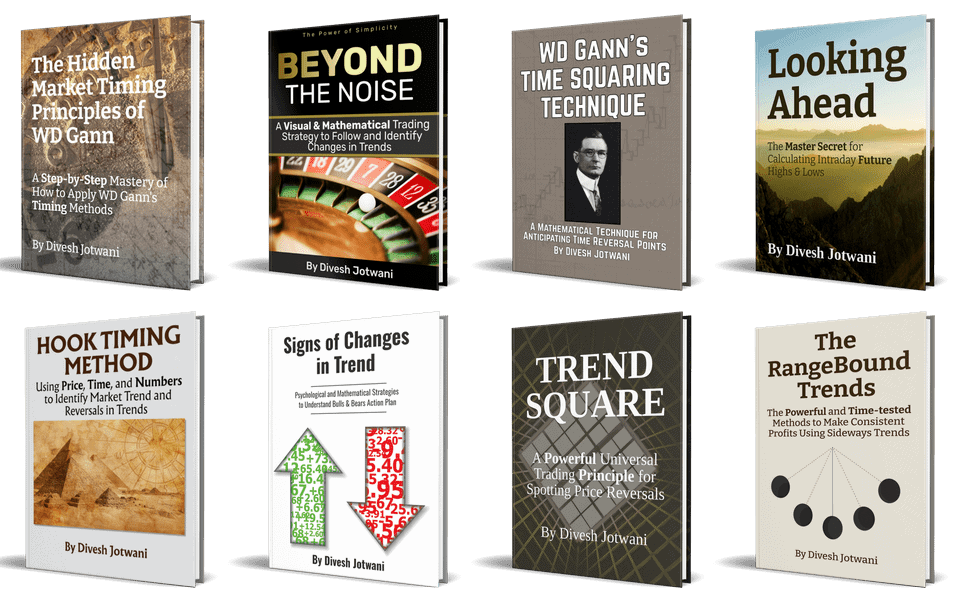

That’s where W.D. Gann’s trading methods and principles stand out. His approach, based on geometry, time cycles, and ancient principles, offers a different path — one that’s helped many traders break free from the noise and see the market in a whole new light.

That’s the path we explore through our courses — and for many, it becomes the turning point in how they truly understand the market.

From Random to Real

In trading, progress often hides in plain sight.

It’s not about doing more — it’s about seeing more.

It’s about noticing what most overlook: those invisible lines that quietly separate luck from intention, movement from momentum, and action from actual growth.

Risk.

Momentum.

Market knowledge.

They’re not tactics. They’re thresholds.

And once you start seeing them clearly, you begin to trade differently — not just with more wins… but with more peace, confidence, and purpose.

That’s the shift. That’s the journey — from random gains to real growth. – Divesh