Most trends don’t reverse without warning. They reach a point where the next move in the same direction becomes a low-probability, high-risk move. This is the stage where the trend is stretched, overextended, and likely to reverse.

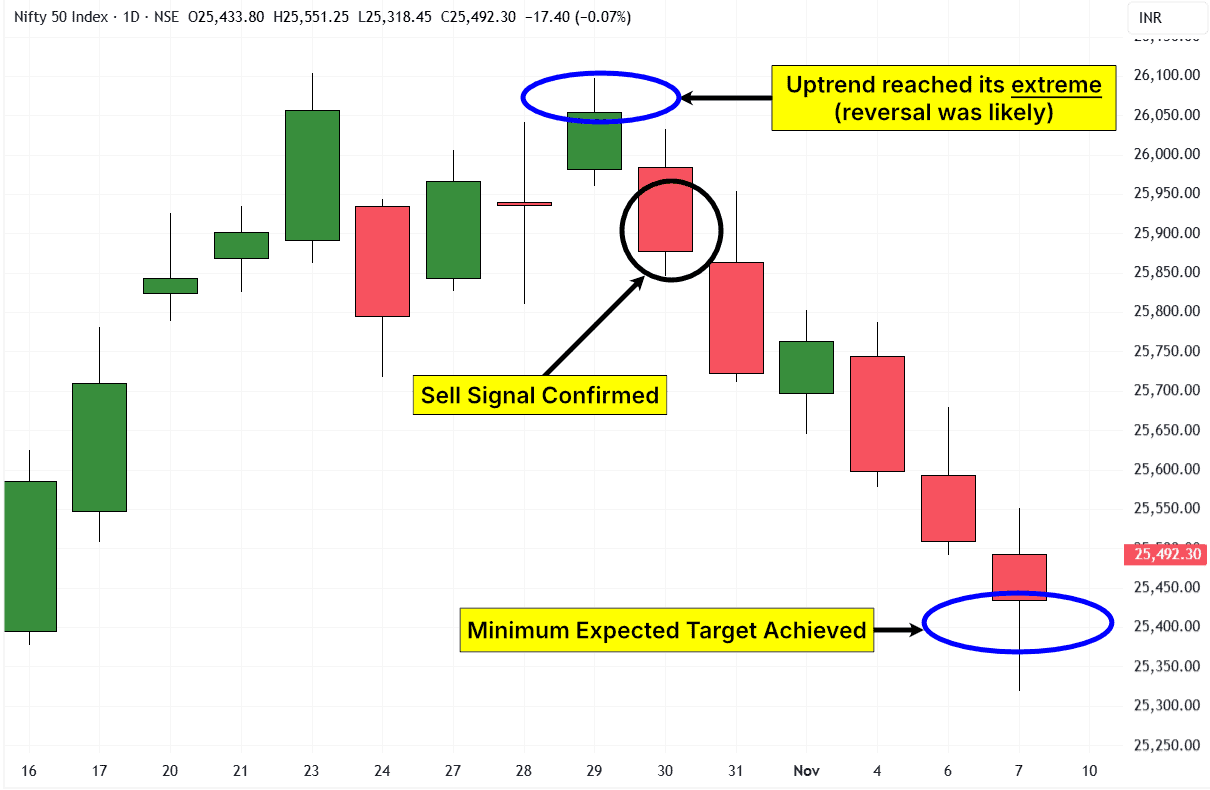

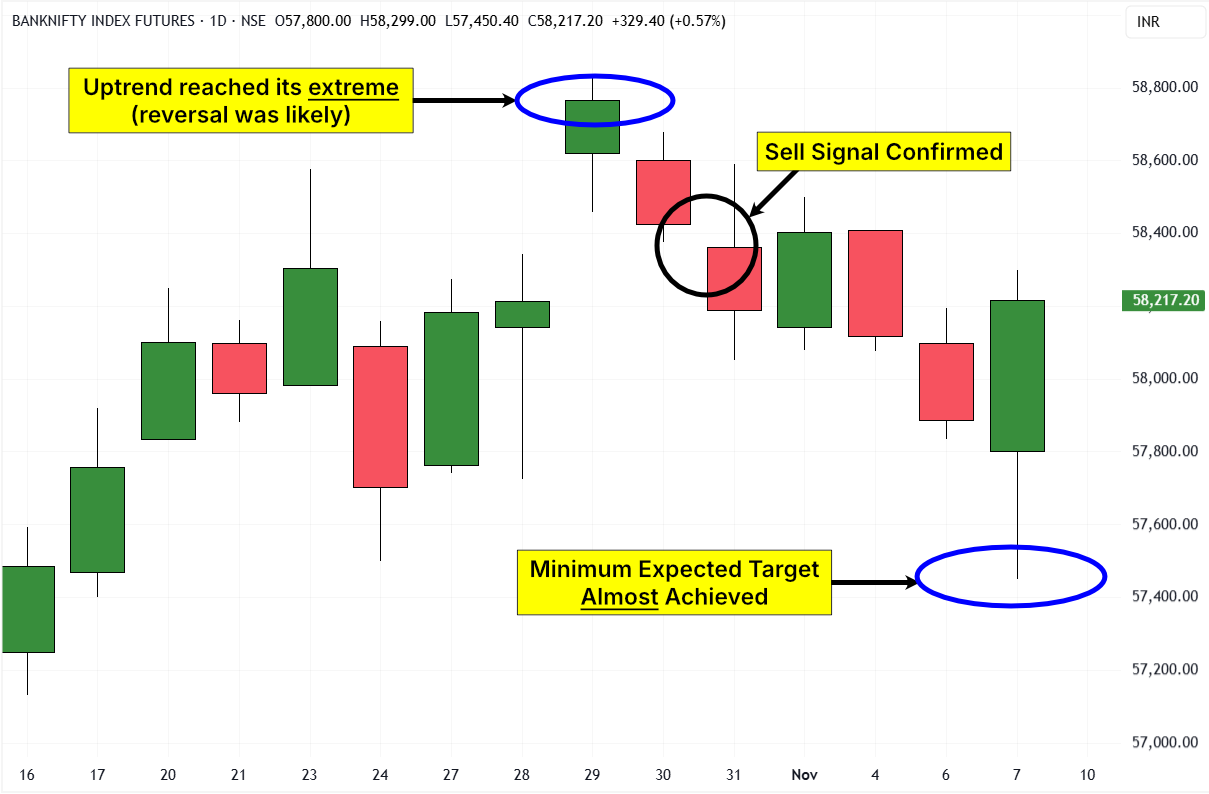

We saw this recently in the Nifty 50 and in the Bank Nifty.

All of them reached a zone where continuing the trend further offered little reward while the risk increased sharply. At that point, a reversal became more probable. From there, blindly following the trend would have been a mistake.

This isn’t guesswork. It isn’t pattern recognition or news reaction. It comes from natural market structure — the same mathematical laws Gann worked with.

The goal isn’t to call the exact top or bottom. The goal is to recognise when the trend has reached its extreme, step aside from chasing it, and wait for a clear, low-risk entry with defined stops.

That’s the process inside The Hidden Order.

You don’t trade because you feel like trading.

You trade only when the odds are in your favour and the risk is small.

You can learn more about the Hidden Order Course by clicking here.

If you’d like to know more, you can reach me directly at [email protected].