If you try to understand how WD Gann traded by looking online, you’ll quickly begin to feel confused.

There are countless explanations, each focusing on a different aspect of his work. Some talk about angles. Others focus on numbers. A few rely heavily on mythology or philosophy.

One thing often overlooked when discussing Gann is how WD Gann actually traded.

Gann did not work with isolated ideas. He followed a clear, structured way of studying markets. His focus remained on time, price, structure, and rules. When these elements are seen together, his work stops feeling mysterious and starts to make sense.

This article explains how WD Gann traded, based on his own writings and methods, without myths, hype, or shortcuts.

Why most traders misunderstand how WD Gann traded

A common mistake traders make is trying to copy parts of Gann’s work without understanding the thinking behind it.

They focus on individual tools or techniques, hoping one element will explain everything. That was never how Gann worked. His methods only make sense when viewed as a complete approach.

Gann believed that serious trading required study and preparation. Without that foundation, his work can appear complicated or even confusing. In reality, it follows a clear internal logic.

Once the full picture is understood, the pieces begin to fit together.

Gann’s starting point: understanding market behaviour

Gann began with a simple belief: Markets move according to natural laws, not by chance.

He believed that price movements reflect human behaviour—fear, optimism, accumulation, and distribution. These behaviours repeat over time, and that repetition creates structure in markets.

This belief explains why Gann spent so much time studying historical price data. He was not looking for the same prices to appear again. He was studying how markets behaved, how movements unfolded, and how similar patterns of behaviour repeated over time.

In short, Gann believed the future reflects the past through recurring patterns, rhythm, and timing.

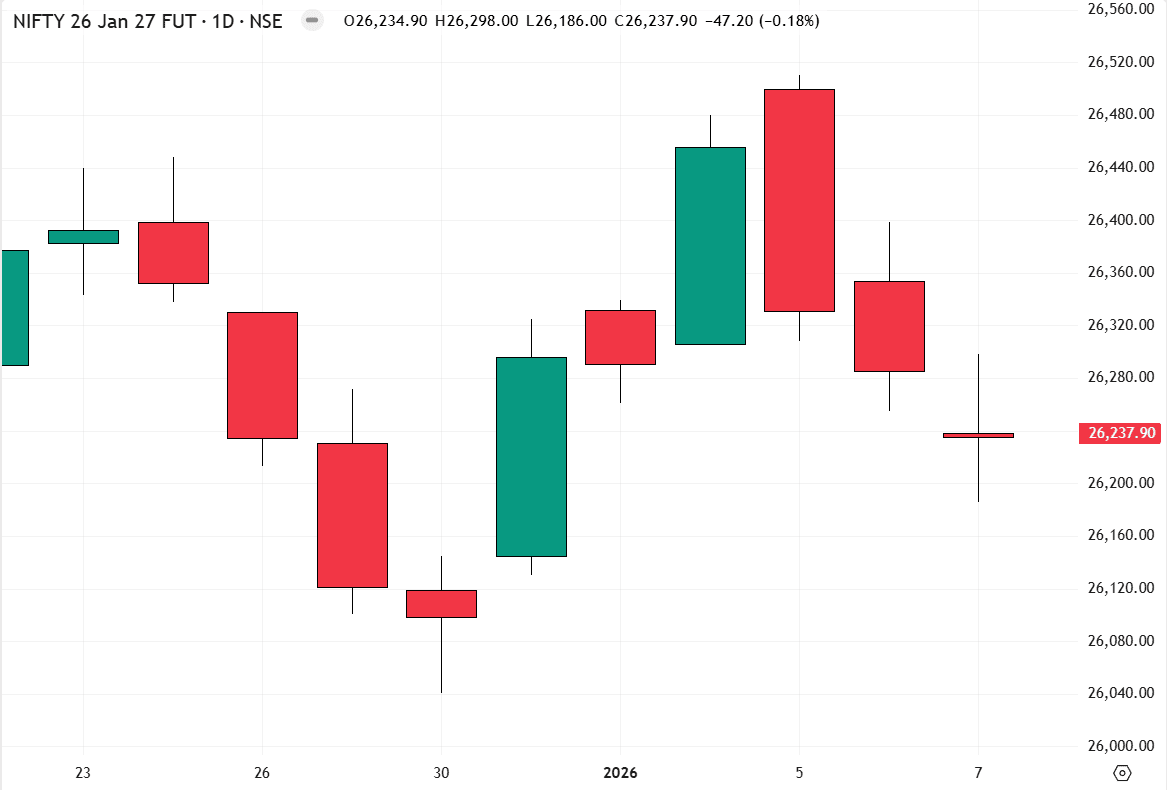

Time and Price Were Always Studied Together

One of the most misunderstood aspects of Gann’s work is how he studied time and price.

Gann did not separate the two. Price on its own had limited meaning, and time without price had no practical value. Market movement made sense only when the price was viewed in the context of time.

He observed that markets often reached critical phases around specific time periods. During those periods, price behaviour showed whether the market was preparing for change or continuing its direction.

Time provides the context. Price shows the result.

This is why Gann focused so closely on past market movements. He studied how price behaved during key time periods and how structure developed as a result.

In short, time gives context. Price gives meaning. Both are equally important.

These time-price relationships are explored in greater depth in The Hidden Market Timing Principles of WD Gann and WD Gann Time Squaring course, which focuses on understanding how timing and structure appear together in real markets.

Structure Mattered More Than Indicators

Gann did not rely on indicators to understand the market. Indicators could reflect recent movement, but they could not show where the market stood within a larger move.

His primary concern was market position. He wanted to know whether a move was just beginning, already well developed, pausing, or nearing completion. This understanding came from observing how the price progressed over time.

By studying how swings developed and how movement carried forward, or failed to do so, Gann could judge whether a move was part of a larger campaign or only a temporary reaction.

His every decision was guided by market structure and position, not by indicator readings.

This idea of identifying the primary trend using mathematics and structure is explained practically in the Beyond the Noise course, which focuses on separating meaningful market movement from short-term fluctuations.

Trends were the foundation of every trade.

Trend was the starting point of Gann’s work.

He defined trend using mechanical rules and treated it as part of a larger market cycle. Major trends, minor trends, and short-term movements were studied in relation to one another.

Rather than assuming change, Gann worked with trends that were already clearly defined. A shift in trend had to be clear through his rules before it mattered.

Gann repeatedly stated that most traders incur losses when they trade against the trend or without a clear plan.

Why Copying Tools Does Not Work

Gann angles, squares, and numbers fail when they are used without context.

Every technique was used within:

- a time framework

- a trend context

- a clear structural setup

Without this context, the tools lose meaning.

Gann’s angles were not magic lines. They were reference points. Numbers acted as guides. When these elements are treated as standalone systems, their purpose is lost.

Gann’s strength was never the tool itself. It was the thinking behind how and when it was used.

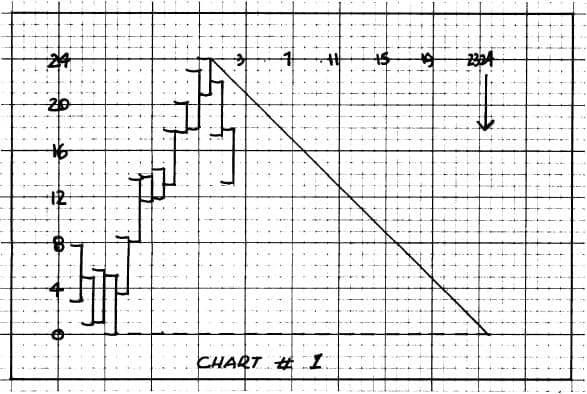

How Gann viewed forecasting

Gann believed markets could be forecasted, but only within precise limits.

For him, forecasting meant identifying likely time windows, probable price zones, and the market’s structural condition. Highs and lows were not guessed. They were projected through the relationship between time, price, and structure.

Forecasts served as guides, not certainties. Risk control was always part of the process.

These forecasting ideas are explored further in Looking Ahead, The Hidden Order, and the WD Gann Time Squaring Course, where time, price, and structure (pattern) are studied together through real market examples.

Forecasting helped set expectations. It never replaced discipline.

What Modern Traders Get Wrong About Gann

Many modern traders approach Gann’s work seeking shortcuts or ready-made answers.

Gann’s work demands the opposite. It requires study, testing, and a willingness to think through how markets develop over time.

He expected traders to think, test, and verify. He did not spoon-feed results. This is why Gann’s methods feel difficult to many.

Those who approach Gann seriously begin to see clarity, while those who approach it casually often remain confused.

What You Should Learn from How Gann Traded

The real lesson from Gann is not a single technique. It is an approach and a process.

From his work, you learn to:

- Respect time as a key market factor

- Read price structure clearly

- Follow rules without emotion

- Protect capital at all times

- Focus on preparation rather than prediction

These principles do not change. Markets evolve, but human behaviour remains the same.

This is why Gann’s work continues to matter today.

Final thoughts

WD Gann traded using rules and defined principles. His work was structured, disciplined, and grounded in careful observation.

Those who study how he actually traded, rather than chasing myths, begin to see markets more clearly and make decisions with greater confidence.

This way of thinking also forms the foundation of our work, not by copying Gann, but by understanding the logic behind his approach and applying it in a practical, modern context.

That is where Gann’s real value lies. – Divesh

Frequently Asked Questions

Did WD Gann really forecast market tops and bottoms?

Gann believed markets could be forecasted within limits. He worked with time periods, price levels, and market structure (patterns) to identify likely turning points. These were not guesses, but projections based on study and rules.

What did WD Gann mean by studying time and price together?

Gann believed price movement only makes sense when viewed over time. Time provided context, and price showed how the market responded within that context.

Did WD Gann use indicators in trading?

Gann’s work focused on market position, structure (patterns), time, and price movement. He relied on rules and observation rather than indicator-based analysis.

Can Gann’s methods still work in modern markets?

Markets evolve, but human behaviour does not. Because Gann’s work was built around behaviour, structure, time, and price, many traders still find his principles relevant today.

What was the foundation of Gann’s trading approach?

Preparation, rules, market position, and the relationship between time and price formed the foundation of Gann’s work.