Most traders talk about Gann numbers. But very few understand how W.D. Gann actually used numbers in trading.

Over the years, Gann’s work has been reduced to shortcuts, wheels, calculators, and surface-level ideas. What’s often missing is the core logic behind how Gann worked with numbers and why he relied on them so heavily.

This post explains the logic clearly, without mysticism or overcomplicating things.

What Most Traders Get Wrong About Gann Numbers

The biggest mistake traders make is treating Gann numbers as magic formulas.

Gann did not use numbers to predict markets in a mystical way.

He used them as measurement tools.

Numbers helped him:

Measure price movement

Count time intervals

Judge when a move was balanced, extended, or complete

Once you understand this, Gann’s work stops looking mysterious and starts looking systematic.

How W.D. Gann Used Numbers in Trading

This is the part that most articles never explain clearly.

Gann used numbers to answer three practical questions:

How far has the price moved?

How much time has passed?

Is price and time in balance?

That’s it.

He was not searching for lucky numbers.

He was measuring distance and duration.

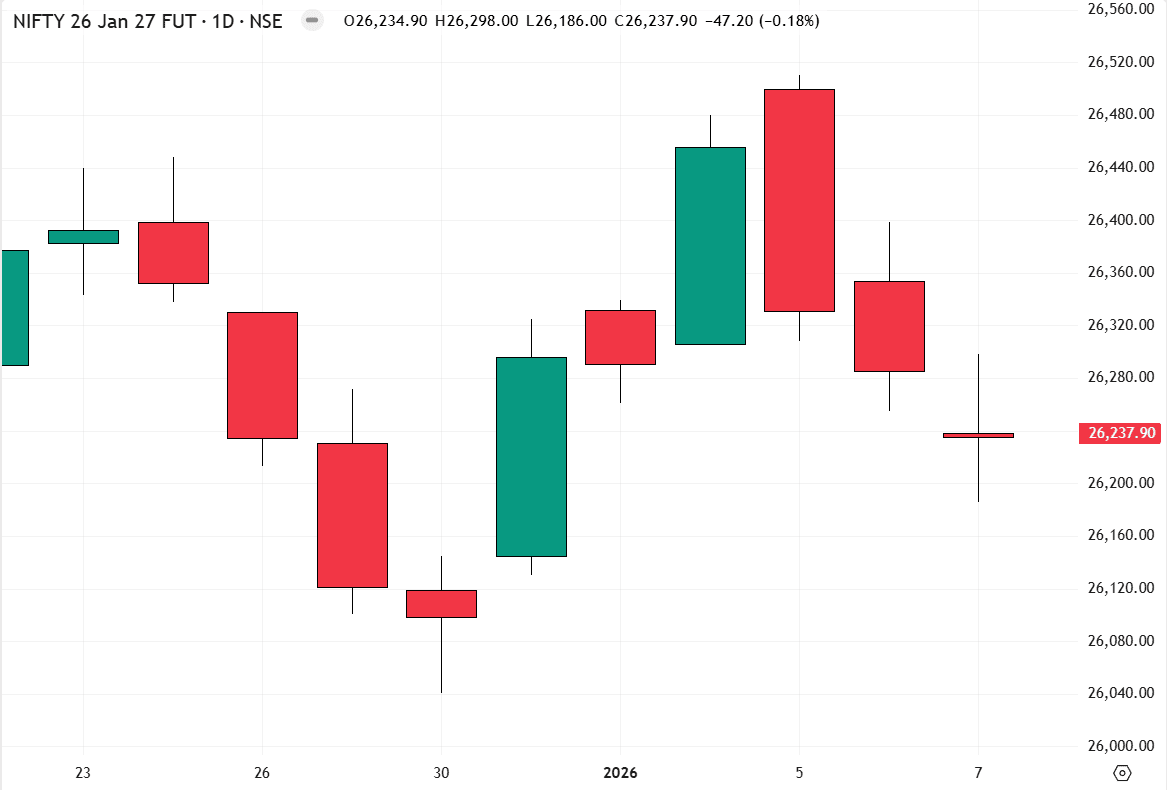

When the price moved a certain numerical distance and the time reached a specific count, Gann observed that markets often reacted. These reactions were not guaranteed, but they were high-probability levels or zones.

This is why numbers mattered to him.

They provided a framework for comparison (crucial) and not just for predictions.

The Gann Number System Explained Simply

Gann focused heavily on natural numbers because markets tend to move in repeating, countable patterns.

These numbers helped him:

Break price into measurable units

Track repetition in time

Compare past moves with the present times

This is where many traders get lost.

They jump straight to advanced tools without understanding that Gann’s work was built on simple numerical observation, repeated again and again across markets and timeframes.

Numbers, Time, and Price: The Core Relationship

Gann never looked at numbers in isolation.

Numbers link time and price together.

Price without time is incomplete. And, Time without price is meaningless.

By counting time and measuring price together, Gann could judge:

Whether a trend is still intact or approaching a reversal.

Whether the move was mature

Whether a reaction was likely minor or important

This relationship was the backbone of Gann’s work, and it’s missing from most modern explanations.

How Gann Numbers Are Used in Real Trading

When applied correctly, numbers help traders:

Identify important price levels

Understand when a move is overextended

Distinguish minor corrections from significant trend changes

Avoid reacting emotionally to noise

This does not require indicators or complex software.

It requires structure, patience, and consistency.

Numbers don’t tell you what will happen.

They help you understand where you are in the market structure.

That alone gives clarity most traders never achieve.

Common Misunderstandings About Gann Numbers

Let’s clear a few things up.

The Gann Square of 9 is not a magic wheel

Numbers alone do not predict markets

Gann never relied on one tool

Context matters more than calculations

Want to Go Beyond Just Theory?

Understanding how Gann worked with numbers is only the starting point.

Most traders stop at concepts.

They read about numbers, time, and price, but they never learn how to apply them consistently to the real market structure.

Gann’s work was practical.

He used numbers to measure price movement, track time, and judge when a trend was changing, not just chase predictions.

If you want to go beyond surface-level explanations and understand the numerical structure behind Gann’s methods, that’s exactly what my work focuses on.

The goal is simple:

Less confusion

Less noise

More clarity about where the market stands

This is not about collecting tools.

It’s about learning how to think the way Gann approached the market.

These courses go deeper than theory. If you want to understand the numbers and mathematical structure behind Gann’s work, feel free to email me at [email protected], and I’ll be happy to help you. – Divesh