A trade isn’t a win just because price moves your way; it’s a win only when you exit at the right time.

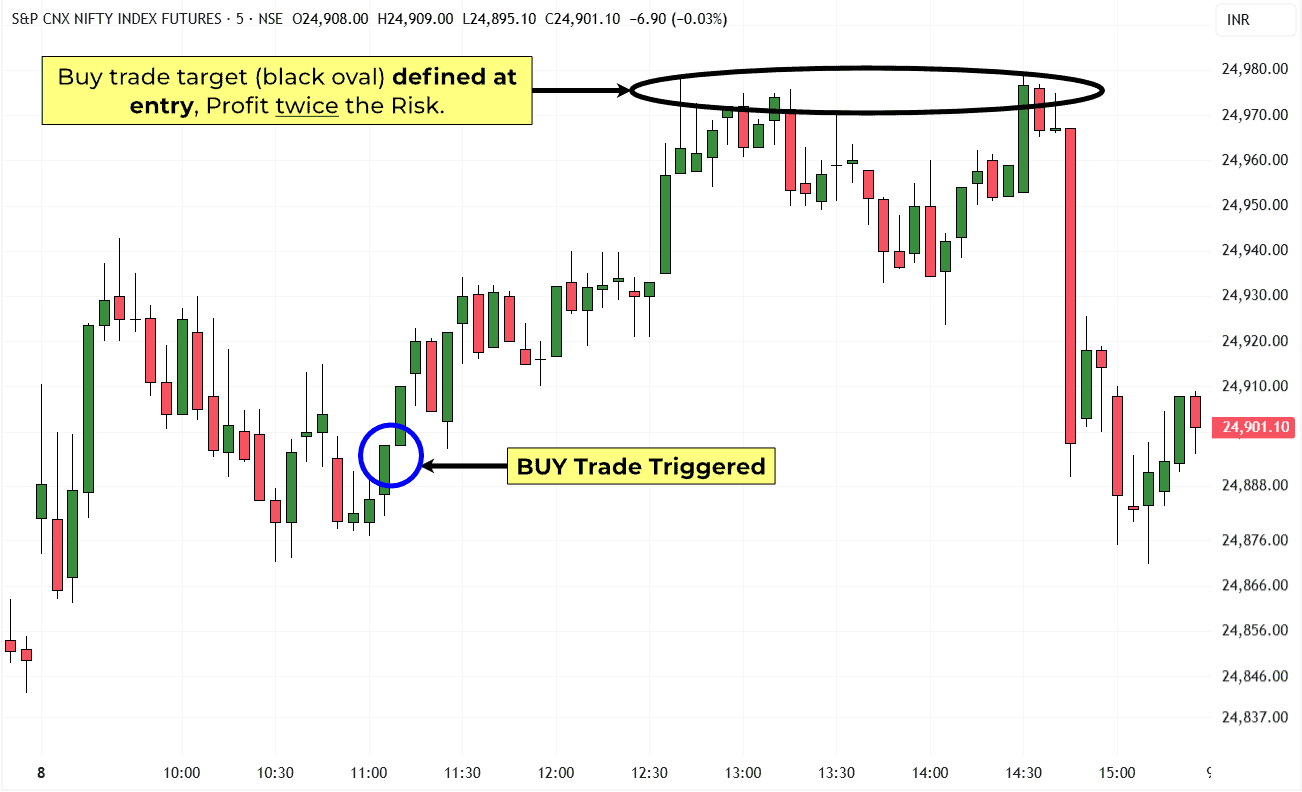

Here’s today’s Nifty intraday example that clearly explains the above point.

On the 5-minute chart, a Buy trade was triggered. Price hit the 1:2 target. Trade closed—clean win.

What happened next? Nifty tumbled. In just minutes, it gave back the entire move and erased the day’s gains.

This is where the difference shows up:

The trader with the right exit walked away with a 1:2 win, locked and done.

The trader with a wrong exit, who held on in hope, saw profits vanish and ended up with a loss.

This isn’t theory—it’s proof. Your exit timing defines the outcome, and it’s what separates a professional from wasted effort.

Entries may open the door, but exits determine what you actually take home.

A trade isn’t complete until the exit is locked. That’s not an opinion-it’s a rule: the exit decides what stays in your account.

P.S. What you saw here is a glimpse. In The Hidden Order Course, you learn and master a complete, rule-based mathematical trading system that ties exits, entries, and sizing into one. The most important and powerful work (course) I’ve published so far.

You can learn more about this new course by clicking here.

If you’d like to know more, you can reach me directly at [email protected].