Most traders know what to do. The problem starts when they stop doing it after being wrong once.

That hesitation usually shows up after a loss. The next setup appears, looks valid, yet isn’t taken. Not because the market has changed, but because confidence has. The loss itself isn’t the real damage. The damage is the hesitation that follows.

Once that sets in, traders begin doubting their process and quietly avoiding trades. The fear of being wrong again takes control, even though nothing meaningful has changed in the market.

This is also why many traders prefer confusion over clarity. A logical trading approach demands action. It defines where to enter, where to exit, and how much to risk. There is no room to delay or hide behind interpretation.

Complicated and traditional strategies feel safer because they create mental distance. More indicators and more rules make it easier to shift blame when something fails. Responsibility feels diluted.

Markets, however, don’t move because of complexity. They move because of behaviour, structure, and positioning. Approaches that align with this feel uncomfortable because they are simple, direct, and make the outcome feel personal.

What actually changes this pattern is not confidence or motivation, but defining risk before action. When the downside is fixed and accepted in advance, hesitation reduces.

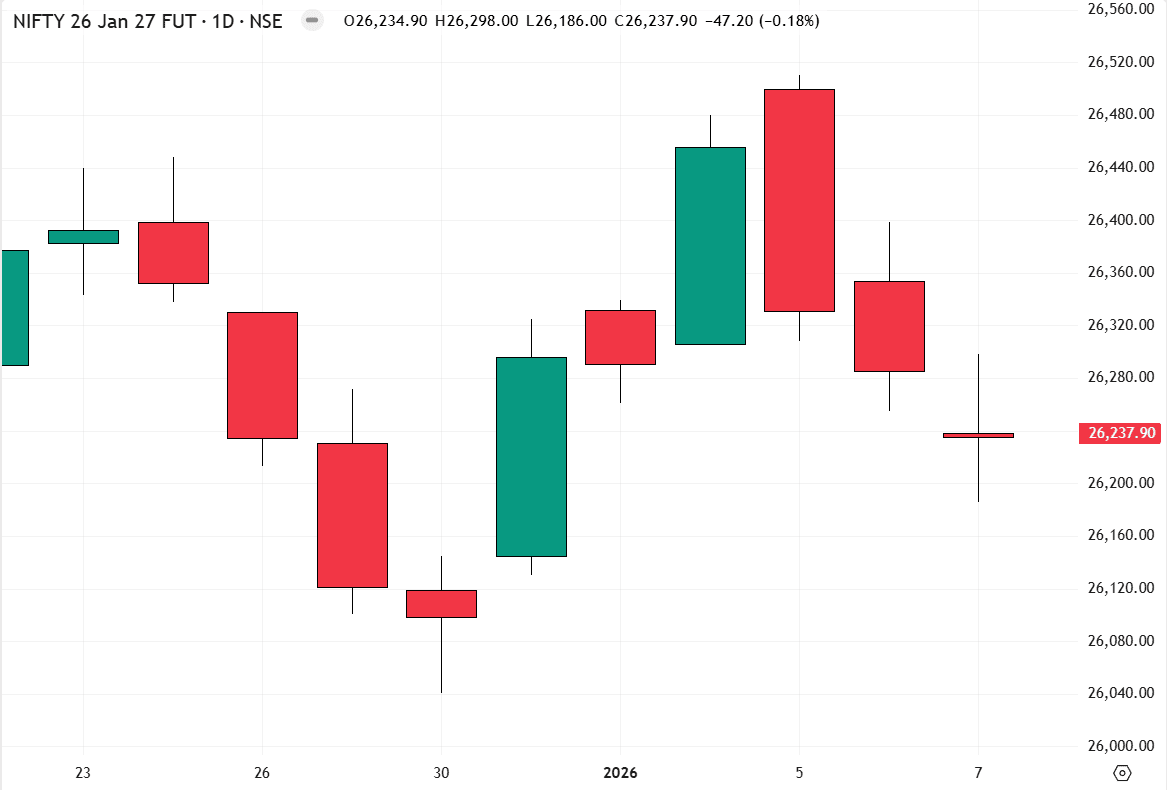

Below is a simple intraday example showing how pre-planned exits remove hesitation and emotional decision-making.

In both cases, the outcome was decided before the trade began, not during the move.

When outcomes are defined in advance, both profit and loss are handled the same way. A losing trade starts to feel like a planned expense rather than a mistake. That’s when decisions shift from emotional reactions to rational execution.

This is exactly why I focus on and follow a rule-based trading framework. When entries, exits, and risk are defined upfront, hesitation has no room to grow.

That thinking is at the core of The Hidden Order.

If you want to purchase The Hidden Order course or need more information, you can email me at [email protected]. I’ll be happy to provide you with all the details you need.