Traders often look for certainty in markets, but certainty doesn’t exist.

What you can have is a process — rules that turn decisions into a plan that the market itself can validate. The strength of that process is tested in real-time, as the market unfolds.

That played out in Bank Nifty with striking clarity.

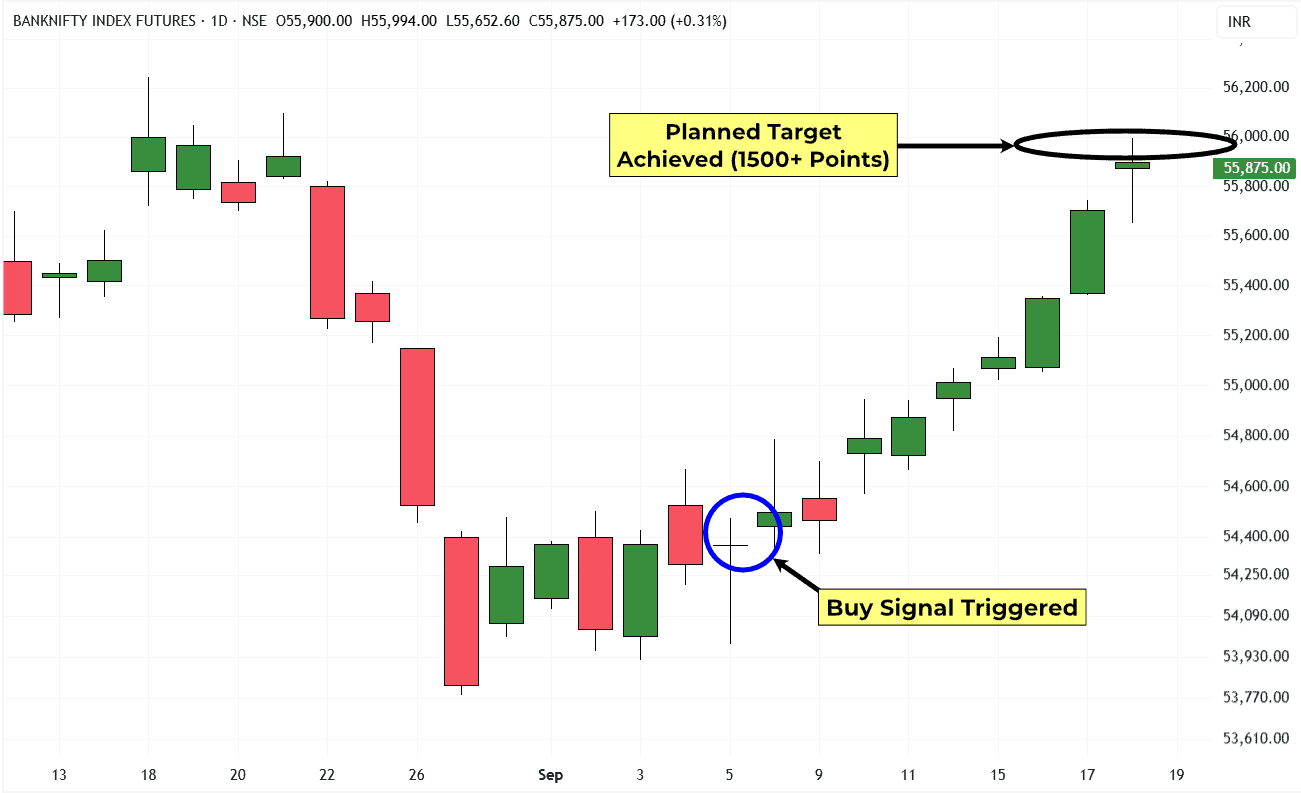

As discussed in last week’s post, the buy setup in Bank Nifty reached its planned exit, completing the move as defined. The chart below shows that exit point clearly.

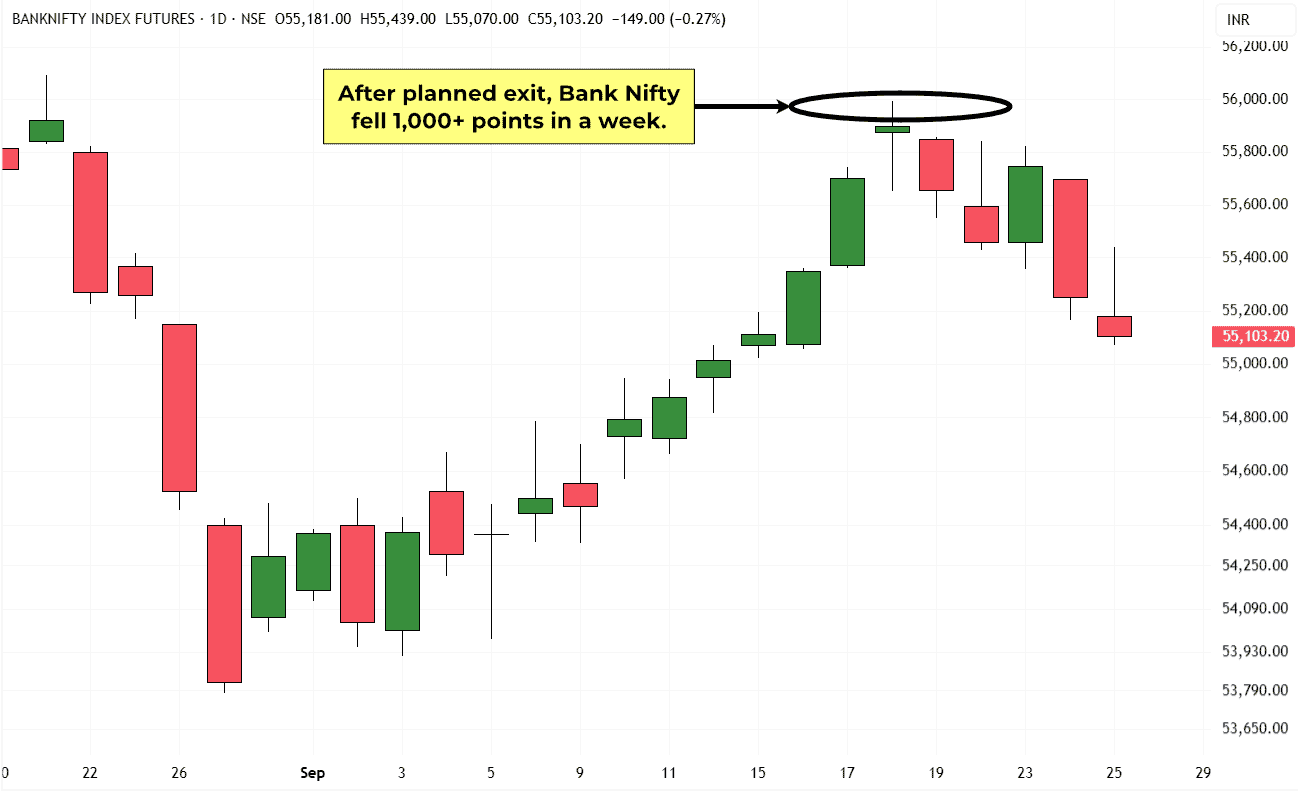

After that, the index did not rally further. It reversed and fell by over 1,000 points within a week.

That reversal had meaning beyond the price drop — it confirmed that the exit was precise, aligned with the true turning point of the move.

That’s what validation looks like. The market itself confirmed the exit with precision. The real takeaway is the validation — proof that the rules held exactly where the move turned.

Many traders chase perfection and the final point. But what builds real confidence is when the market validates your plan under pressure. That confidence lets you apply the same rules repeatedly, across different trades and conditions.

That is the philosophy behind The Hidden Order. It’s not about predicting the future, but about having a framework that the market continues to validate — in real-time, with real results.

If someone is still asking for “proof,” they’re looking in the wrong place. This very move is the proof, the market itself is the only evidence that counts, and here it has spoken with precision.

You can learn more about this new course by clicking here.

If you’d like to know more, you can reach me directly at [email protected].