Most traders focus on market direction — but direction alone doesn’t make a winning trade..

Every strong move forms in stages, and waiting until those stages are complete can make the difference between a failed trade and a successful one.

Why Waiting Matters

Markets don’t switch from non-trending to trending instantly.

They go through a build-up — smaller moves, pauses, and shifts in momentum — before a strong run begins.

If you act in the middle of this process, you’re trading something that hasn’t fully formed, and you risk getting caught in a move that fails to continue.

Think of a trade setup like a chain reaction.

One step triggers the next, and only when all the steps are complete does the real move begin. Miss one step, and the move often fizzles before it even starts.

That’s why Gann always stressed the importance of patience — not just spotting a setup.

The Mistake That Costs the Most

Most traders make one of these errors:

They enter as soon as they see a setup forming, hoping to “get in ahead.”

They act on a pattern before all the confirming conditions are met.

They jump on breakouts without confirming if the move will hold.

In every case, the real problem is the same — acting before the move is ready. The result? The trade fails, backfires, or goes nowhere, which also keeps your money (trading capital) stuck.

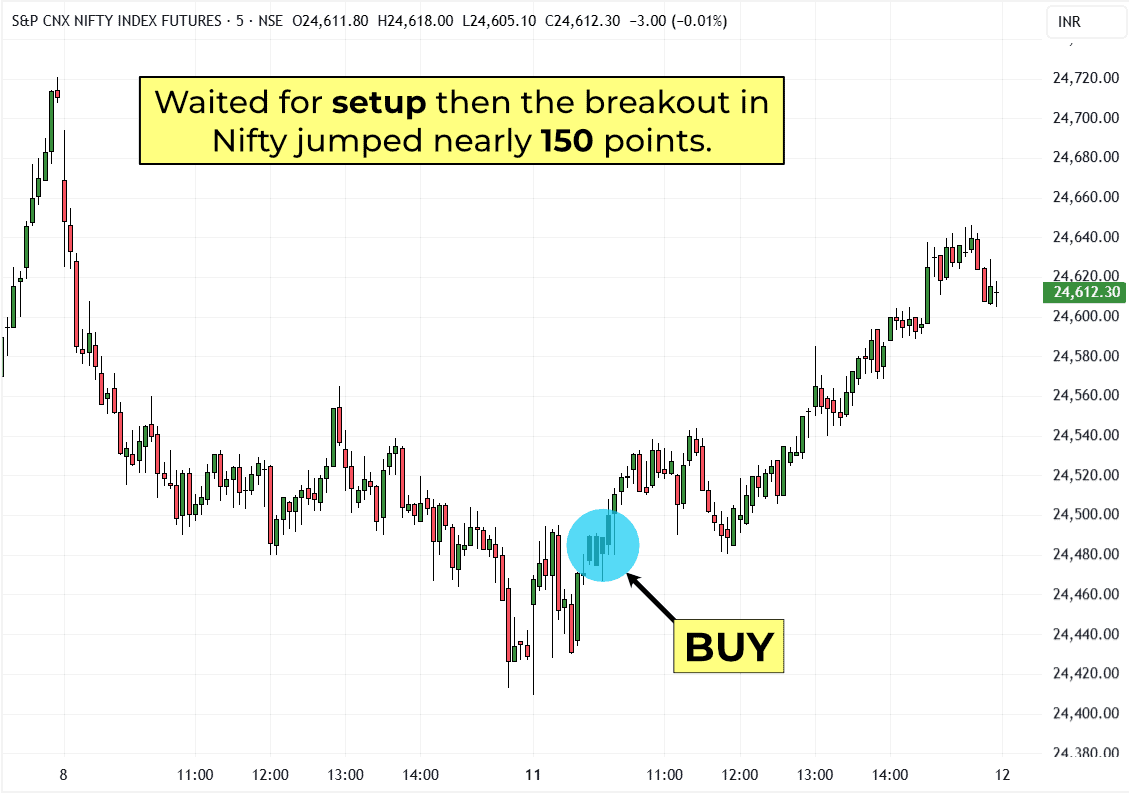

In today’s session, the Nifty 50 again proved why timing matters.

After Friday’s sharp fall, the index broke out to the upside and climbed nearly 150 points during the day.

Price broke out and kept climbing, but it happened only after the setup was complete — a reminder that the right moment matters much more than the direction.

That’s precisely what Trading the Universal Sequences is built to capture — recognising when a move is ready so you act at the strongest point, not too soon.

Pinpointing Trades Worth Taking

Our course Trading the Universal Sequences helps you avoid these mistakes.

It combines a Natural Sequence that reveals trend setups, a Mathematical Sequence from Gann’s Tunnel Thru the Air that distinguishes between major and minor turns, and a confirmation process that filters out false breakouts.

Instead of guessing, you act when the move has the highest chance of running — because most strong trades or moves come when the whole setup is in place.

Your job is to wait for that moment — not a step early, not a step late. – Divesh

If you want to know more about Trading the Universal Sequences, you can email me at [email protected].