One of the biggest traps in trading is bias — expecting the last move to continue. What does that look like?

After a sharp decline, the mind expects more selling. After a strong rally, it expects more buying. That instinct feels natural, but it often leaves traders late, hesitant, or stuck on the wrong side.

Markets, however, don’t reward bias. They reward process.

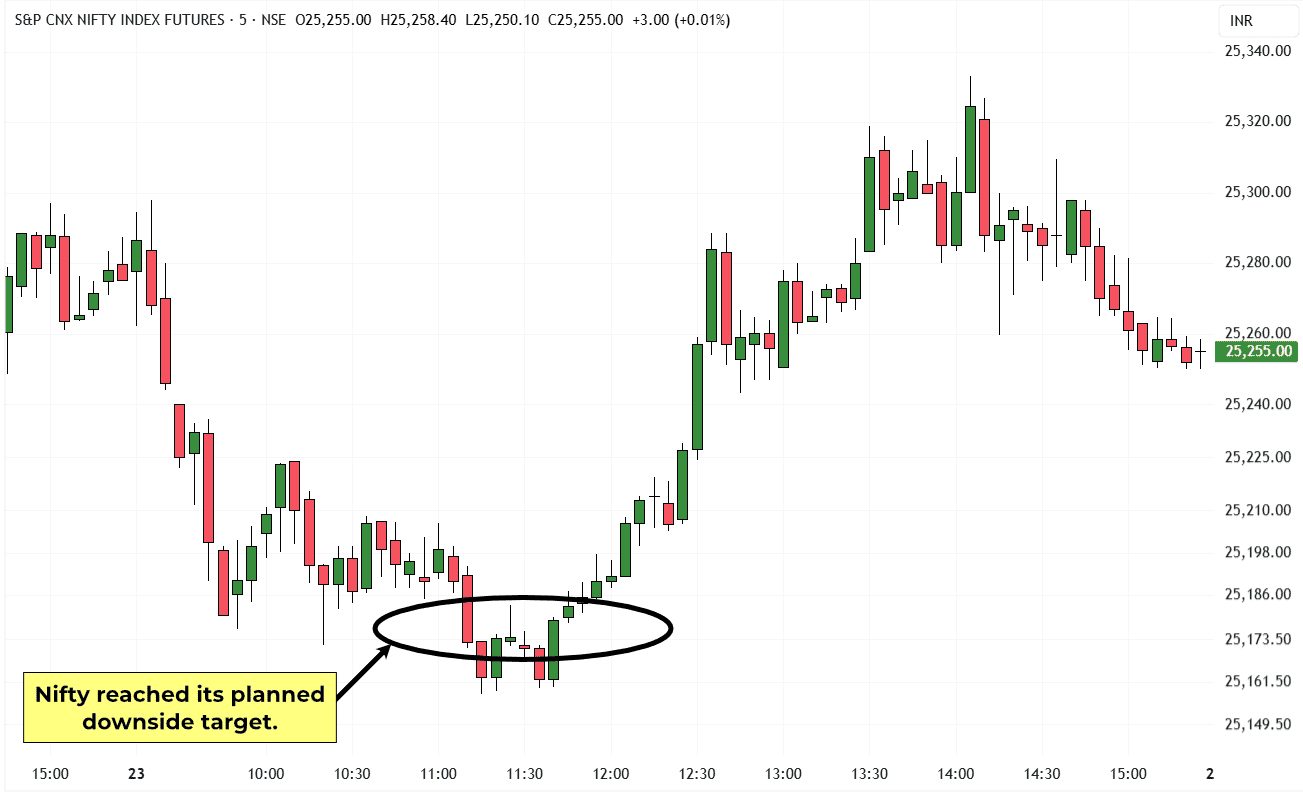

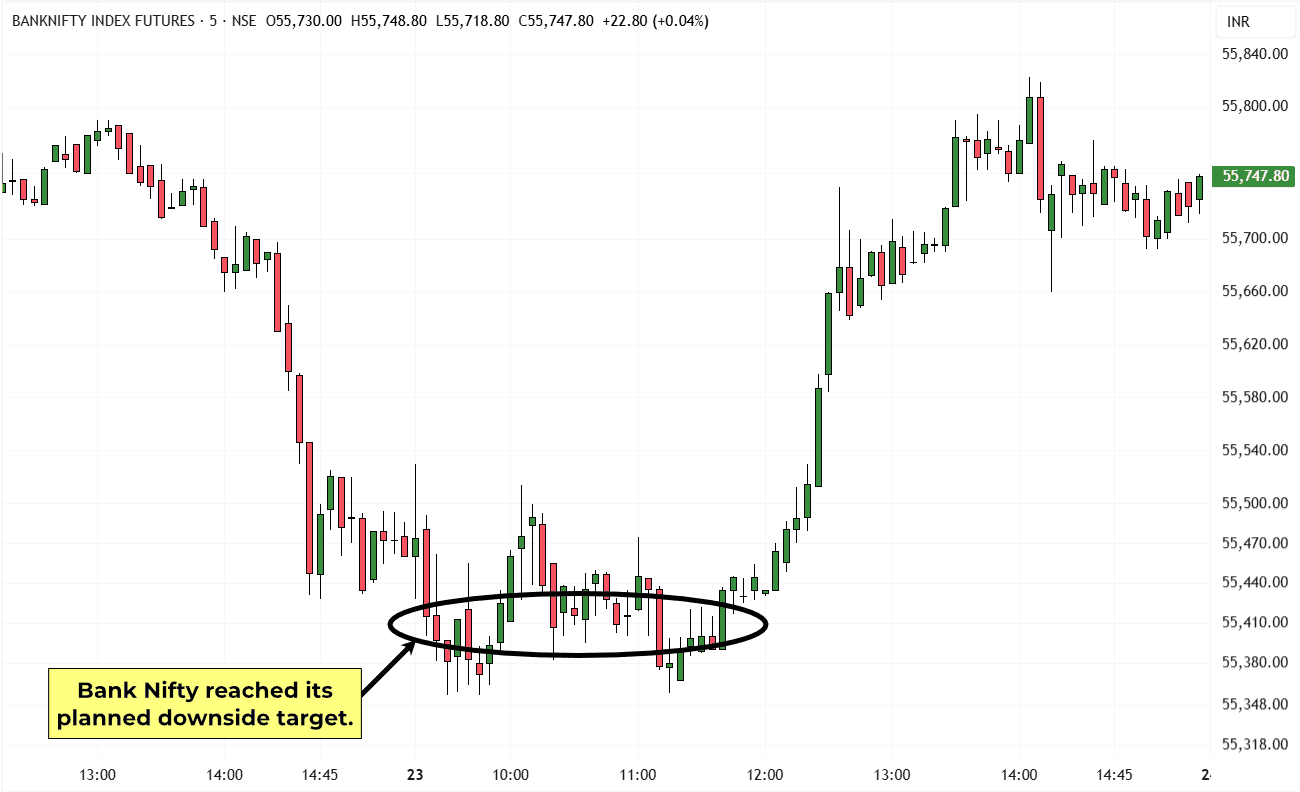

We saw this in today’s intraday movements of the Nifty and Bank Nifty.

Both initially declined and reached their downside targets. A biased trader would have remained bearish, expecting the decline to continue.

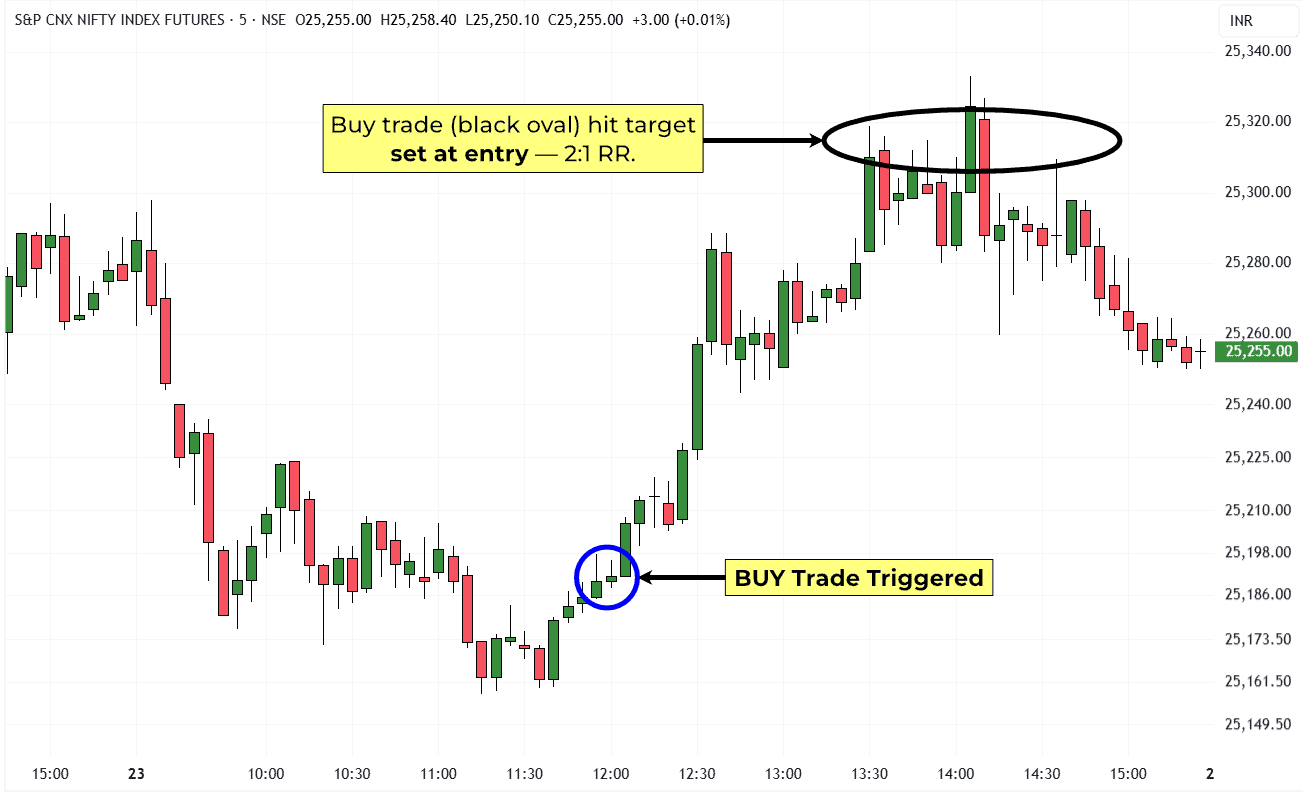

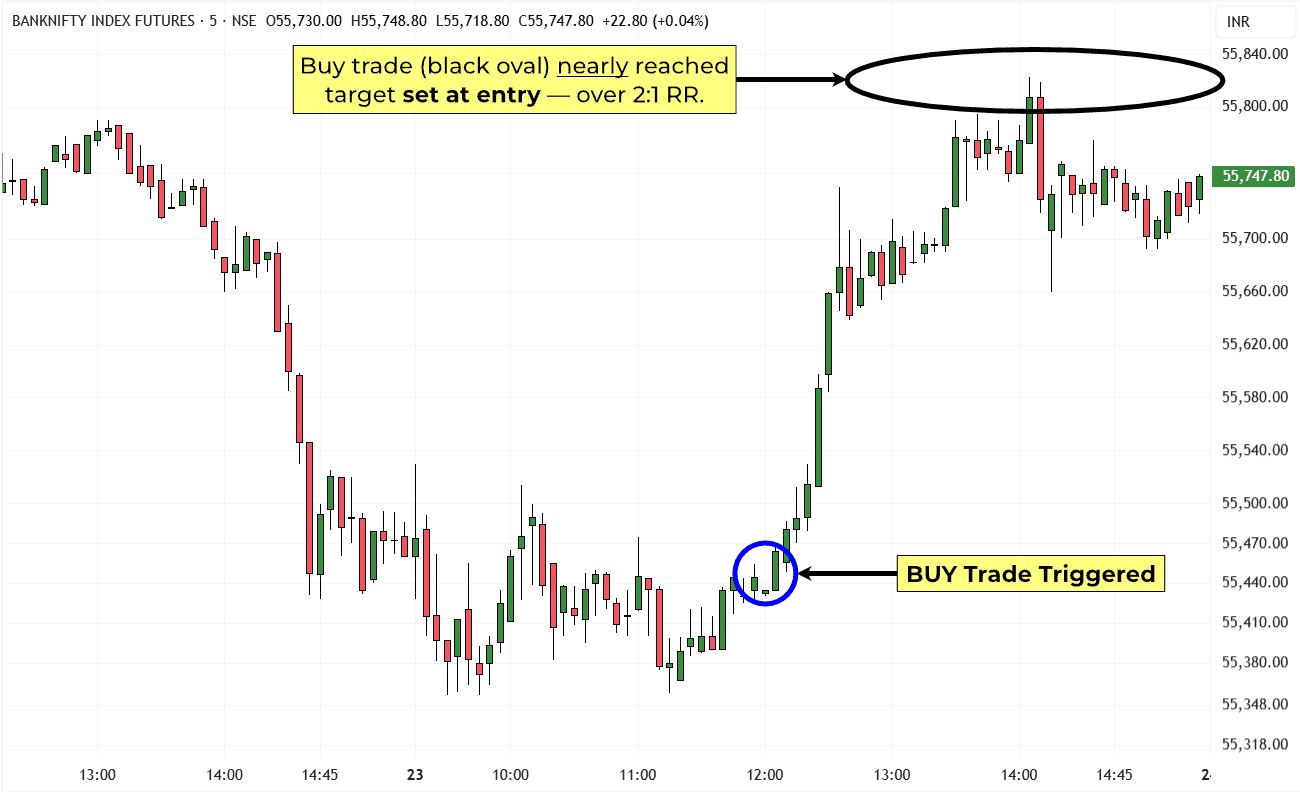

But soon after, buy signals were triggered. Both indices then rallied and completed their upside targets with precision.

The point is simple: consistency doesn’t come from sticking to a view. It comes from rules that switch when the market switches.

Bearish or bullish, downtrend or uptrend, the process was the same — entry defined, trade managed, target completed.

That’s what removes chance from the equation. By overriding bias and following rules, you create results that are reliable across different trades and market conditions.

That’s the foundation of The Hidden Order. It’s a rule-based mathematical framework that shows how trades can be systematically planned and executed from start to finish, so consistency becomes a function of process — not opinion.

You can learn more about this new course by clicking here.

If you’d like to know more, you can reach me directly at [email protected].